image text translation

What if the U.S. stock market crashes?

How would it turn out if you only invested at the high point?

99

There is a man in the world who is the worst at understanding market timing.

all:

After all, his name is Bob. soup

The World’s

Worst

Market Timer

Bob, who was sincere and diligent, passed away in 1977 at the age of 23.

After getting my first job

1970 1980 90 2000 Retirement by 2070

For the frame

I have made a savings plan.

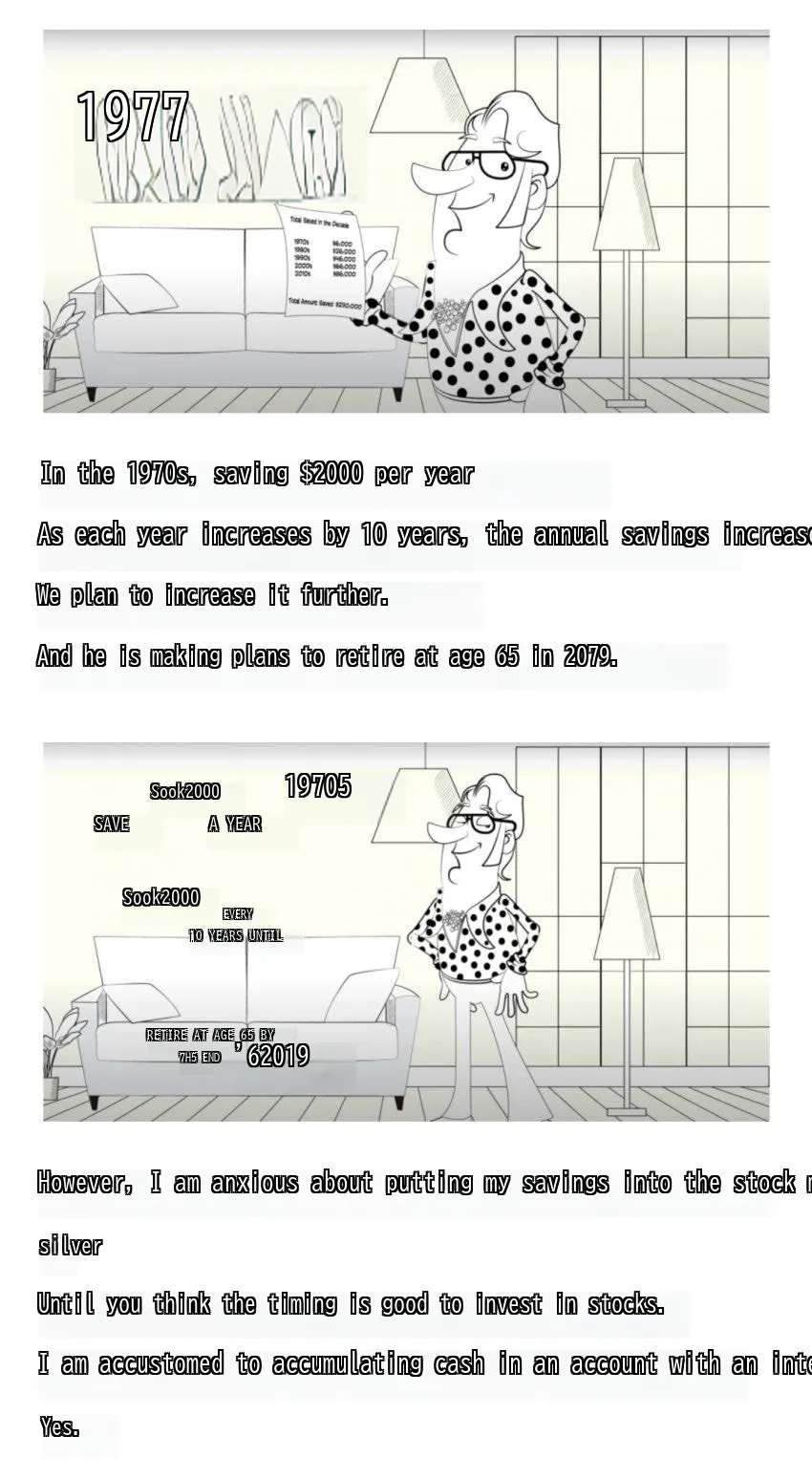

1977

image text translation

In the 1970s, saving $2000 per year

As each year increases by 10 years, the annual savings increases by $2000.

We plan to increase it further.

And he is making plans to retire at age 65 in 2079.

Sook2000

19705

SAVE

A YEAR

Sook2000

EVERY

10 YEARS UNTIL

RETIRE AT AGE 65 BY

7H5 END

‘62019

However, I am anxious about putting my savings into the stock market.

silver

Until you think the timing is good to invest in stocks.

I am accustomed to accumulating cash in an account with an interest rate of 0%.

Yes.

096

image text translation

But the problem with rice is

After the bull market has passed, stocks are closing in.

Now, it is better to have the courage to decide whether to invest or not.

MARKET

So from 1977 to 1980, the market rose 60%.

Watch what you do

In July 1980, the $8000 I had saved

It’s hot to invest in the S8P5OO Vanguard Induct.

INTEREST

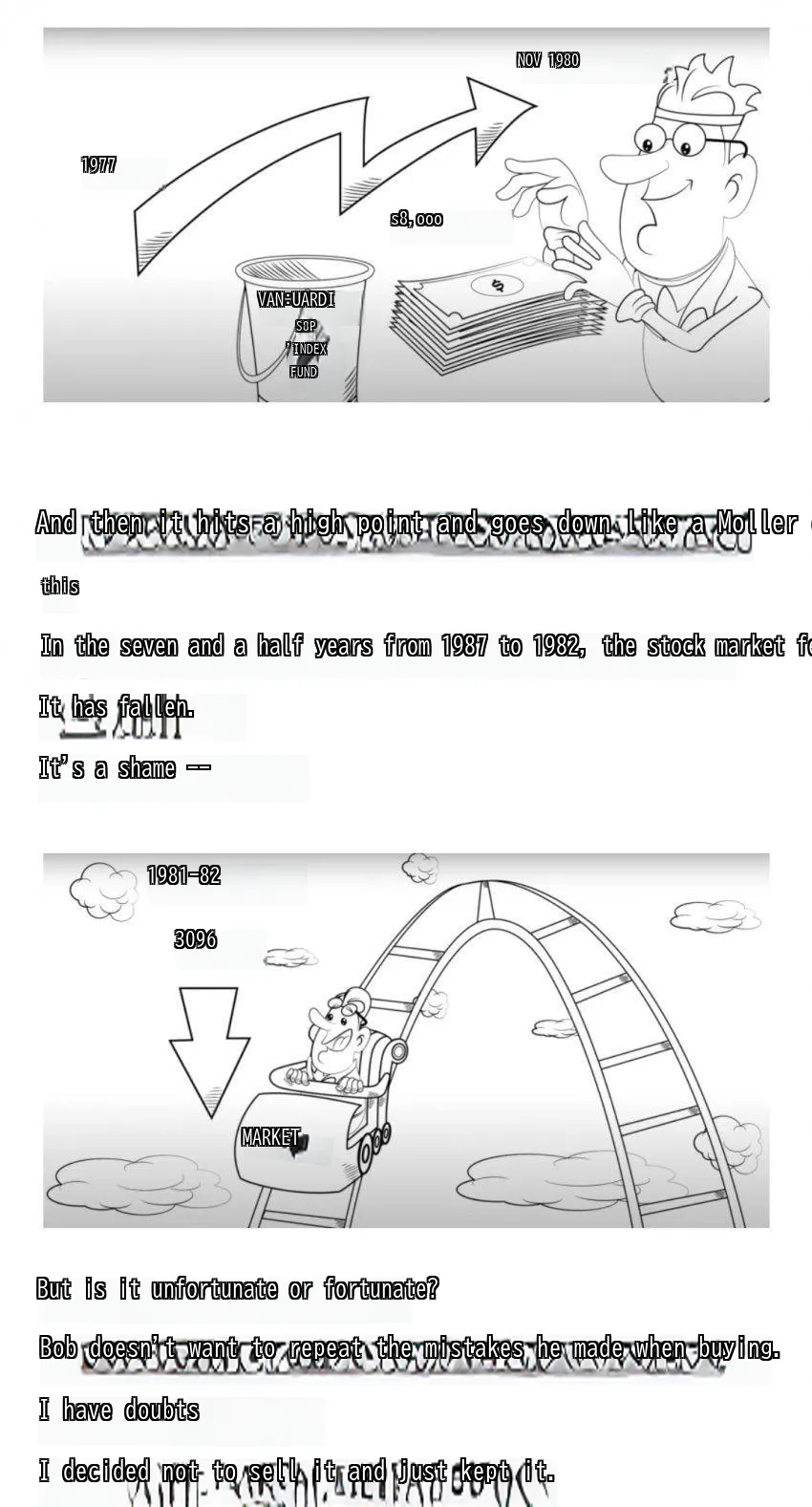

NOV 1980

image text translation

1977

s8,ooo

VAN:UARDI

S8P

‘INDEX

FUND

And then it hits a high point and goes down like a Moller coaster.

this

In the seven and a half years from 1987 to 1982, the stock market fell 30%.

It has fallen.

It’s a shame —

1981-82

3096

But is it unfortunate or fortunate?

Bob doesn’t want to repeat the mistakes he made when buying.

I have doubts

I decided not to sell it and just kept it.

MARKET

MARKET

image text translation

=0

=:

66

Although it boiled at its peak and the market fell,

Decided to just hold it instead of selling it.

I hope you remember Bob’s decision:

Because that’s the point of this story.

99

Referrer +his decision

However, the rice that I was afraid of buying at a high price and being bitten

image text translation

I couldn’t put all the cash I saved into buying stocks right away.

We wait until September 1987.

After the bull market has passed for a while, rice is now available.

I feel the courage to buy again with the cash I used to save.

1987

August

The cash I saved over 7 years is now $76,00001.

Bob invested again in S8P5OO,

And in history, Bullek fell by more than 30% in just one day.

It’s hot on Monday.

This is truly unlucky Aiken.

YEARS LATER

image text translation

8 16,ooo

CRASHJNE

S8P

3096 + LOSSES

Bob is having no luck with the sales schedule.

Should I just sell stocks again and save additional money?

I decide to just leave it as cash in the bank.

It bothers me that the trauma of Black Monday remains.

It is difficult to purchase additional stocks.

The market rose tremendously until 1999.

go

Bob, who had accumulated $54,000 in cash, returned to the port.

Muster up the courage and suddenly buy everything!

INDEX

454,000

image text translation

Starting from July 2, 1999, the market exploded with

fell -509.

ha

This person says something

454,000

Dec 1999

5096 dowhturr

This man bought fully at the high point right before the recession three times.

I decided not to sell it either.

I decide to make one last purchase again.

However, rice does not disappoint expectations(?)

image text translation

The $50,000 raised in cash was sold in July 2007.

Oct 2007

right

50,000

In 2008, the market fell by -57% due to the subprime crisis.

It fits my whole body.

Poor Bob.

And then buy more stocks until retirement.

image text translation

I swear I have no eyes

I’m just saving up cash until retirement in 2019.

Now, let me summarize.

Bob is the most unlucky person in the market.

I’ve only made a purchase four times in my life, but each time, I’m Se-seon Lee.

I reached the highest point.

Black Morday

image text translation

TECHNOLOGY BUST

1987

2oo0

BNKI

BEAR MARKET

1980-82

FINANCIAL CPIsIs

2007-2009

But what about when Bob retires?

66

After retirement, he became a millionaire.

81.1M (approximately 1.2 billion won) is secured:

99

cor

HELP!

SHARE

How did this happen?

image text translation

(1) First, he steadily saved money, and as he got older, he

Savings are rising.

(2) Although he bought at the peak of the market, he did not sell.

I kept it for over 40 years.

Compound interest worked.

Me0+

image text translation

YEARS

OF INVESTING

66

However, without considering the market timing,

Whether the market goes up or down

Immediately when a certain amount is consistently received

What happens if you invest in the US stock market?

99

His assets are worth $2.5 million (about 2.65 billion won).

no see.

!