image text translation

CHRISTIES

LEIN?N

BROTHERS

(To roughly talk about the economic recession, it would be roughly correct to start with the 2007 economic crisis.)

(Today’s story also starts here)

image text translation

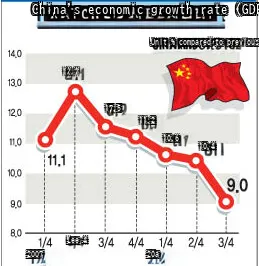

China’s economic growth rate (GDP) trend

Unit % compared to previous year

12,7

17,5

11,2

10.6

10,4

Lee 4

2007

20a

image text translation

Chinese government: (Matak…. GDP is being destroyed due to lack of exports due to the economic crisis, right?)

Chinese government: OK, let’s stimulate domestic demand.

…Then how do we stimulate domestic demand?

image text translation

(

&

r

close

5

facial expressions |

Myeonro N

* – “Junggeumhiro!

UE’

Twine `

(For reference, at this time, China’s domestic demand was dominated by real estate.)

Chinese government: …I have no choice. If we don’t do that, China will fail.

Thinking about future matters later and encouraging real estate speculation!! Gosh!!!

image text translation

Don’t Tone Can Miss Six

Household

Register

4 # ^ Sat # in team 4 to 8 #

UnDr SusSon o Te Mnsliry CI Puot Secunty OPAC

In China, there is an evil law called the family registration system, which is almost like a caste system.

Family registration is determined based on the parents’ family register at the time of birth.

And it’s a crazy law where education, employment, housing, and welfare benefits depend on your family register.

Anyway, the family register system has relaxed the rule that you cannot purchase a house in another city.

Rich people with money in rural areas can now purchase houses in cities.

As housing prices fell, consumption in the region could not stop it.

It was the Chinese government’s plan to revive the domestic market by borrowing power from other regions.

And to buy a house

We also created an environment that makes it easier to borrow, such as easing loan conditions and lowering interest rates.

What are the results?

image text translation

#What is Flex Consumption?

The behavior of showing off one’s wealth through consumption

blue

andN

It was a huge success!

At this time, the speculative craze was so severe that even college students were trying to buy houses with loans.

Anyway, with all the good houses taken away by the frontrunners, the latecomers turn their eyes to other places.

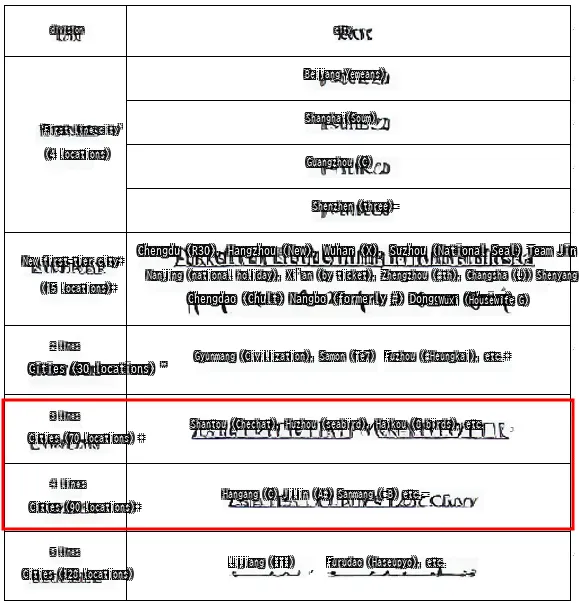

image text translation

division-

city-

Beijang Yemeans)

Shanghai(Soum)

‘First line city’

(4 locations)

Guangzhou (C)

Shenzhen (three)-

Chengdu (R30), Hangzhou (New), Wuhan (X), Suzhou (National Seal) Team Jin ([ #)

New first-tier city+

Nanjing (national holiday), Xi’an (by ticket), Zhengzhou (#th), Changsha (L)) Shenyang (tFE)

(15 locations)+

Chengdao (Chult) Nangbo (formerly #) Dongguan (Choium)

Wuxi (Housewife G)

2 lines

Gyunmang (Civilization), Samon (Te7)

Fuzhou (#Heungkai), etc.+

Cities (30 locations) “

3 lines

Shantou (Chechat), Huzhou (seabird), Haikou (8 birds), etc.

Cities (70 locations) +

4 lines

Hangang (C) Jilin (A#) Sanmang (=B) etc.-

Cities (90 locations)+

5 lines

Lijiang (ITI)

Furudao (Haseupyo), etc.

Cities (128 locations)

Latecomer: Mr. I, the 1st and 2nd lines were all eliminated.

Because China will succeed anyway (influence of the Chinese Communist Party’s brainwashing)

Shouldn’t I just buy the 3rd and 4th lines and save them?

Wow, maybe I’m a bit of a genius?

So, were the latecomers’ plans successful?

image text translation

I’m stuck here

Is that possible? If I had succeeded, I wouldn’t have been writing this lol.

image text translation

Let’s save everyone

I need to get it

profit is poor

There is only one reason it failed

Because there was no reason for people to live there.

Due to the lack of infrastructure, you may be at a disadvantage due to the family registration system, so it is not a popular tourist destination, etc.

Since people do not buy houses in the 3rd and 4th lines, losses will continue to occur.

image text translation

In the end, many people end up in 3rd or 4th tier cities.

image text translation

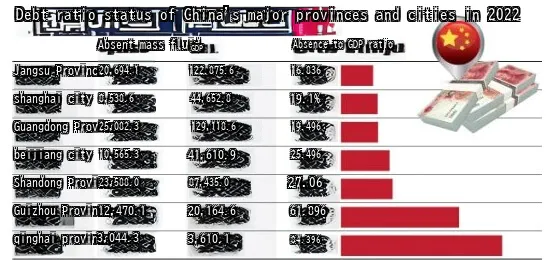

Debt ratio status of China’s major provinces and cities in 2022

Absent mass fluid

GDP

Absence to GDP ratio

Jangsu Province

20,694.1

122.875.6

16.836

shanghai city

8,538.6

44,652.8

19.1%

Guangdong Province

25,082.3

129,118.6

19.496

beijiang city

10,565.3

41,610.9

25.496

Shandong Province

23,588.0

87,435.0

27.06

Guizhou Province

12,470.1

20,164.6

61.896

qinghai province

3,044.3

3,610.1

84.396

Local government: Ugh, I too have been bitten by reckless development ㅠㅠ I think I will go bankrupt if this continues, so please help me ㅠㅠ

Xi Jinping: No, this is crazy… how much is it?

Local government: Even if you estimate it as a small figure, it is 30 trillion yuan (5,500 trillion won).

Xi Jinping: …Okay. I’ll issue bonds, so try to survive with that somehow.

image text translation

[Szter

EVERCRANDEI

(GROUP

Hengda (China’s 2nd largest real estate developer): Hehehe, the local government can hold on by providing bonds.

Because private companies can’t do that.

I’m going bankrupt (death)

image text translation

[Korean Rice]

&aChae

Biguiyuan: Hahahahahahahaha I’ll follow you soon hahaha

image text translation

:

Investors who invested in Hungda: Give me your money, listen to Lee Sae-t…ㅠㅠ

image text translation

Ping Ping: Ha…shit…. I need a cigarette.

One line summary

Japan is doing the same thing it did during the bubble economy and failing.