image text translation

American economist Nassim Nicholas Taleb

Through the book Black Swan published just before the subprime mortgage crisis,

“We can look at the effect and guess the cause, but

“Even if there is a foreshadowing, it is not easy to notice.”

saying

[Even if there was a crystal ball that could see the future one day ahead,

Most investors will go bankrupt within one year]

The uncertainty of the information and

I have talked about the chaos of the economy, etc.

image text translation

Baak

Victor Hagani

James White

Founder & CIO

London

CEO

Philadelphia

Accordingly, capital management partners and CEOs

Victor Hagani and James White

To prove or refute what Nicholas Taleb said

To 118 MBA students from top universities in the U.S.

Provide $50 and a front page in the next day’s Wall Street Journal.

Invest in S&P 500 and 30-year U.S. Treasury bonds

Experiment to see how much profit you can make after 15 days

image text translation

Diriindrtry trrric r3m tuenbiy

Siiaullc vursiuiut

Kniinkulw

‘CIiallIiu]

{l liluikir Whu ltish lllis

Sue

Cl Uungri”MIInaDaIngaSgigi-M-9 3-tubeI5IDaDalb-0755

OVuEh

diziylam]

DrovidinnIhis lund mie

‘rUS JUIU

OldMuth –

‘IIIMI-A

Iriisuirilrlilli’ Tililitn linall (ilsIlisl)e”

aaaOIIIT

Vltal Signs

WmiroTT

andtheTd

Litromnnkhiltm Ki iMi

Companiivs

‘wrimglng

KANUL

pInrulEuslet

‘cenlral tuningr will Mup

wukurg;

uus uline

ucomos

U Kimu

Utrut

IIIaIlhs

Glmnridl dl

T{uVe

EW

mosuitt;

IKJmlp:

SOVIIMLwulmiy

UAind qIa rlur

Sesai] Ki-da In

upoktsmrnlnrth

Iint

Idvn In-imal Wiuli

Inrnlvt is’

HEITZ5I

ut Mlmrrnrutl

Vuuliliene

Ikalua wUrcnrs

ruolot

nir

HasJt]-

Ola

Isare [Xlnrleato

IIgodol

Bobmmnurls

Askur and il

a UIIIIII

‘pEusidertial

“‘sinll

[urlrn

urrninmtraaulfe

Inurusts

htiur

Hnigoa4 –

ha|

CTully stzshll

Irslni

IvruiHidtr

ntr flag

[aa3m

H

IlilrrMdir

tml flag

Audlul

Arieruuuifl

dlunern

SHu

drilmioiln

nyrs riCi

Thu tritar wASMisruitivlt

UcrsIl TTu S Julio

MIruIe;

Gnlt Ici7y durinm irenlhii

anaIIVila

ctrelvnalios

Morgan Stanley

circworirlentirdhw min

Vstar Surianiui

rUrurtid

ETuix

lallban $ attomvt tulaAumruu

(av” AP

eWl C?

eTht Tlhal

CuW”

In Sassa V

{aurrts

Larywsw

Mluull

A’n

‘SI U;

Keis

Nrrw

usaum

rakrlsum

Although the exact numbers are obscured

In the newspapers of certain 15 days

– Maintain monetary policy, euro falls, consumer spending increases

– Orange juice price rises, biotech value surges, economic recovery

– Poor bank performance, decline in Bitcoin, increase in industrial production

Various information that can be used for investment was given, such as

image text translation

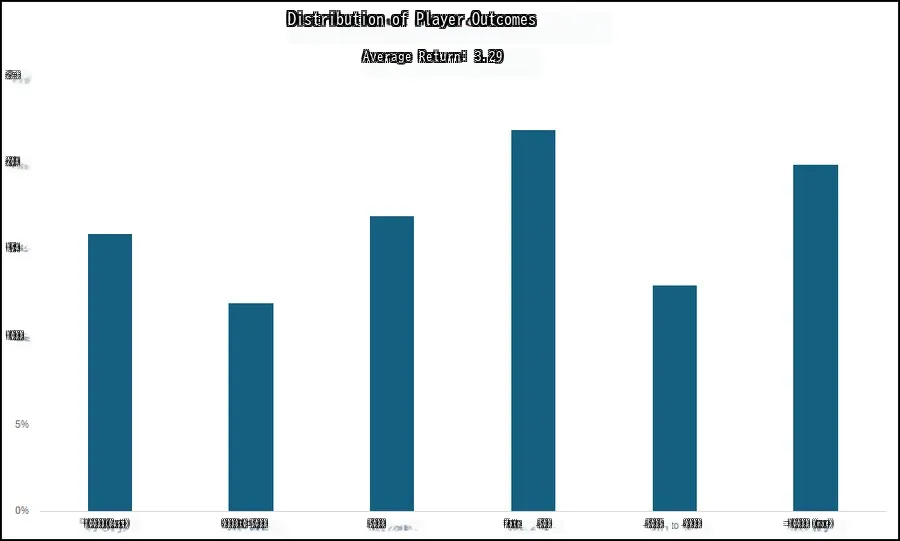

Distribution of Player Outcomes

Average Return: 3.29

25 3

20#

154

1033

~10033(Bust)

9338t0-5033

5038

fate

503

5035

9933

-10033 (mar)

As a result, the average return was 3.2%

45% of experimenters lost money

16% of subjects went bankrupt

Of all 2,000 transactions by experimenters,

The direction hit rate for stocks and bonds was only 51.5%.

image text translation

Nassim Nicholas Taleb

@nntaleb

FOOLED BY RANDOMNESS

My conjecture; expressed on

has been tested by Haghani et al.

Indeed they failed to really capitalize on information 1)

you don’t know

beforehand whatis noise & 2) overestimate the information (sizing)

With DETPL

translation

Translate from English Googl

offer)

be fooled by recklessness

My recommendation for X is that providing news frames in advance does not increase performance.

Not reviewed by Haghani et al:

In fact, they failed to actually utilize the information. 1) What to know in advance

2) The information (size) frame is overestimated.

Regarding the results of this experiment, Nicholas Taleb

“See, I did that.”

He tweeted