image text translation

If the won-dollar exchange rate exceeds 1,410 won, the national pension will be exchanged.

I just found out that there is a gang that needs to intervene in the wool market.

It’s impossible

If the won-dollar exchange rate continues to exceed 1,410 won,

In many cases, there is an investment loss in the national pension, our retirement fund.

This means that this happens:

What does it mean?

What does the national pension have to do with exchange rate defense?

image text translation

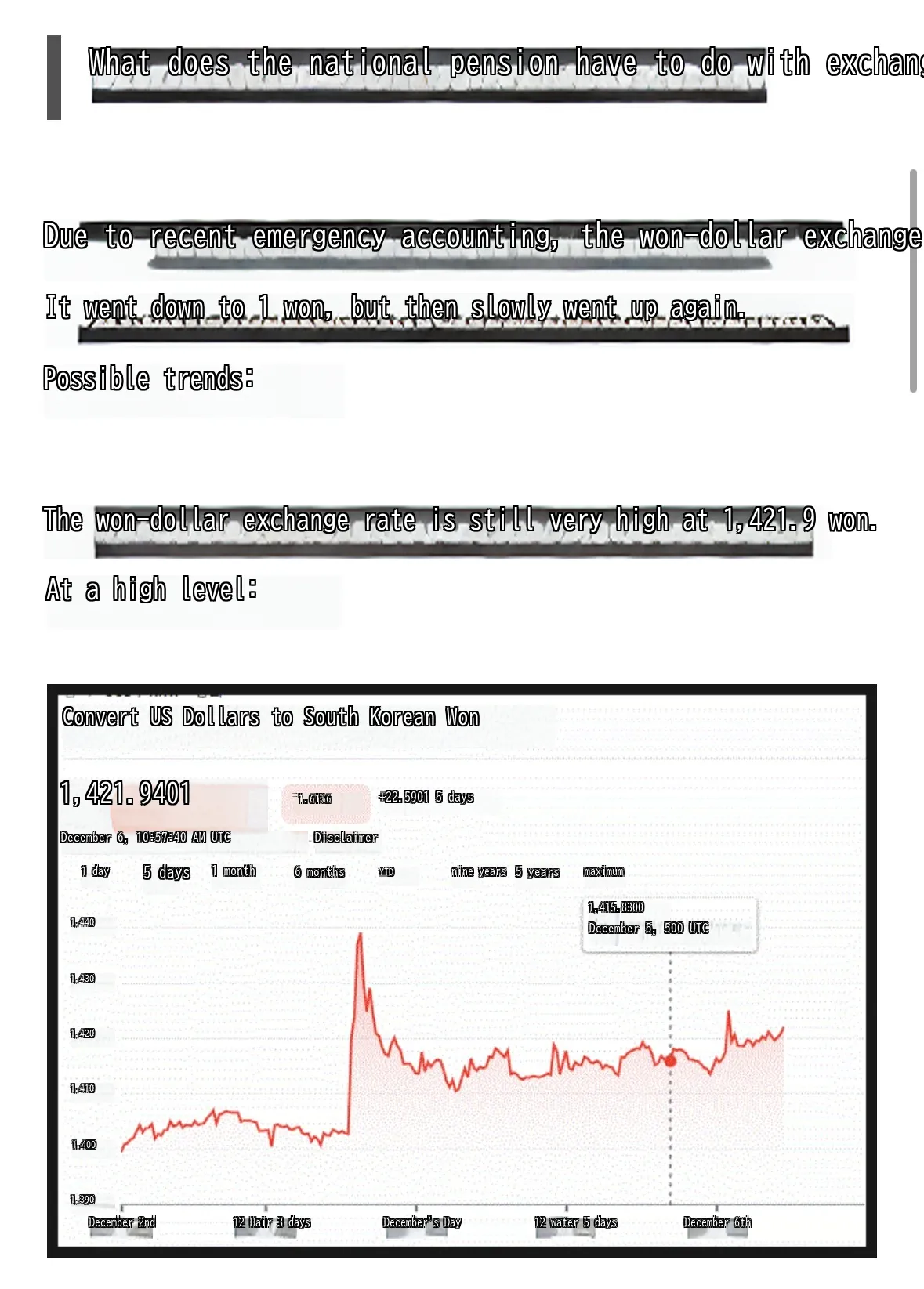

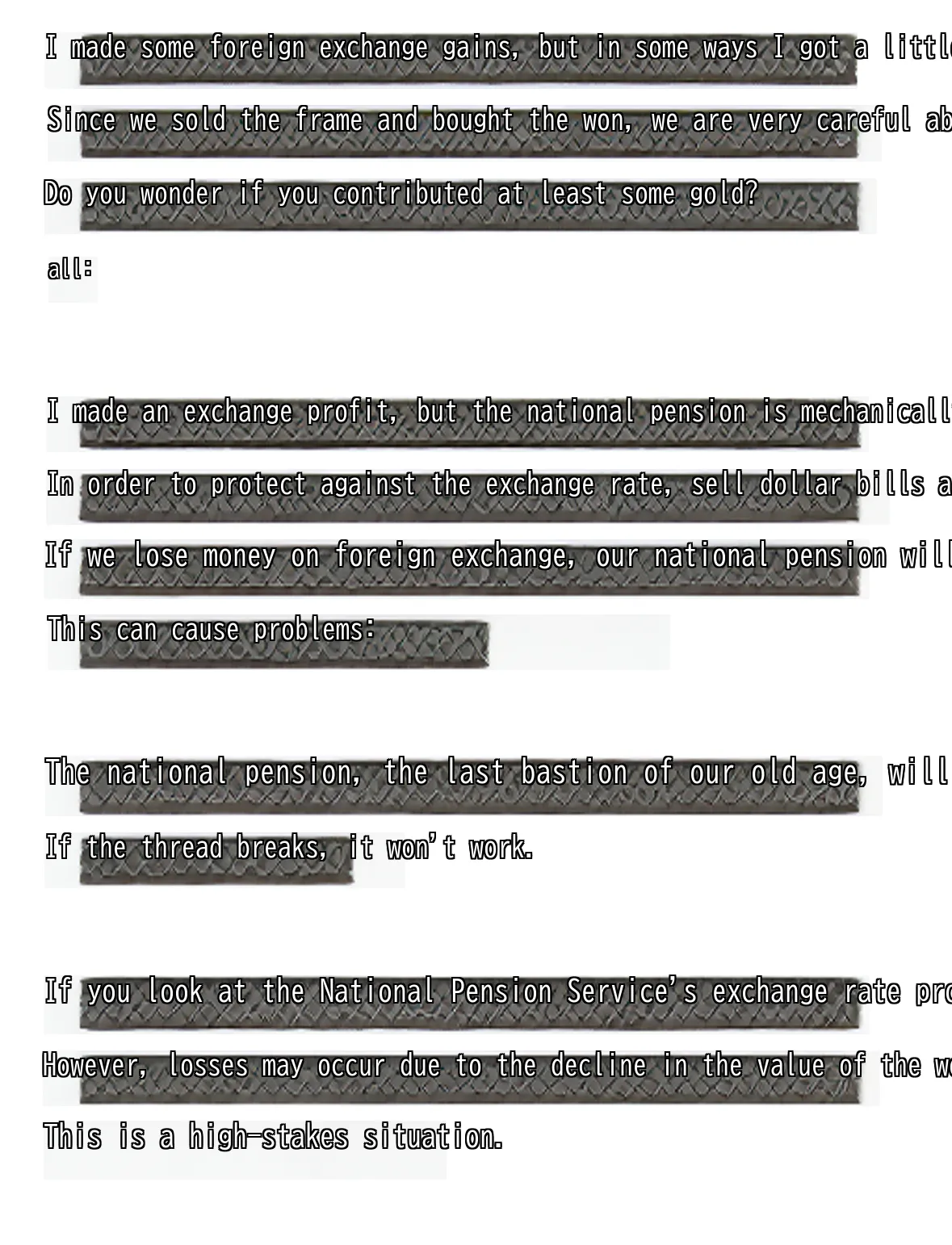

Due to recent emergency accounting, the won-dollar exchange rate has decreased by 1,440.

It went down to 1 won, but then slowly went up again.

Possible trends:

The won-dollar exchange rate is still very high at 1,421.9 won.

At a high level:

Convert US Dollars to South Korean Won

1,421.9401

^1.61%6

+22.5901 5 days

December 6, 10:57:40 AM UTC

Disclaimer

1 day

5 days

1 month

6 months

YTD

nine years

5 years

maximum

1,415.8300

1,440

December 5, 500 UTC

1,430

1,420

1,410

1,400

1,390

December 2nd

12 Hair 3 days

December’s Day

12 water 5 days

December 6th

However, the won-dollar exchange rate reached around 1,410 won.

image text translation

If this happens, the National Pension Service will mechanically sell forward currency.

Let’s go:

Commercial banks, etc. that accepted national pension forward contracts

Geumwoom Institution is to hedge the futures purchase position.

It’s hot to sell dollars on the spot market:

If this happens, the dollar-won exchange rate will fall. In other words, won-dollar exchange

You will be happy.

Overseas assets held by the National Pension Service amount to approximately $400 billion.

Considering that it is close to the strategic hedge ratio,

Up to $40 billion, equivalent to a 10% cap.

This means it can pour into the market.

Since then, the won-dollar exchange rate has been well defended at 1,410 won.

If that happens, you won’t have any problems.

However, if it goes up beyond that, the national pension

image text translation

The foreign exchange hedge will result in an investment loss:

The National Pension Service intervenes in the exchange rate market.

It is not an independent decision, but a request from the state to make the relevant provisions.

The term is automatically included.

Aren’t you a tech patriot?

I confess honestly; The time when the decree is declared:

In other words, when the won-dollar exchange rate and the won-yen exchange rate soar.

I made a profit through currency exchange.

Exchange a very small amount at the won-yen exchange rate of 963 won as shown below.

This year, the foreign exchange gain is about 7%, or about 400,000 won.

Let’s get a shroud. (I was in a hurry to get the won-dollar exchange.

I couldn’t use the screen camera)

I made some foreign exchange gains, but in some ways I got a little bit of yen.

image text translation

Since we sold the frame and bought the won, we are very careful about protecting the exchange rate.

Do you wonder if you contributed at least some gold?

all:

I made an exchange profit, but the national pension is mechanically

In order to protect against the exchange rate, sell dollar bills and make money.

If we lose money on foreign exchange, our national pension will end up being deducted.

This can cause problems:

The national pension, the last bastion of our old age, will never be lost.

If the thread breaks, it won’t work.

If you look at the National Pension Service’s exchange rate protection rate, it is a total number.

However, losses may occur due to the decline in the value of the won.

This is a high-stakes situation.

It’s not a foreign exchange reserve issue.

image text translation

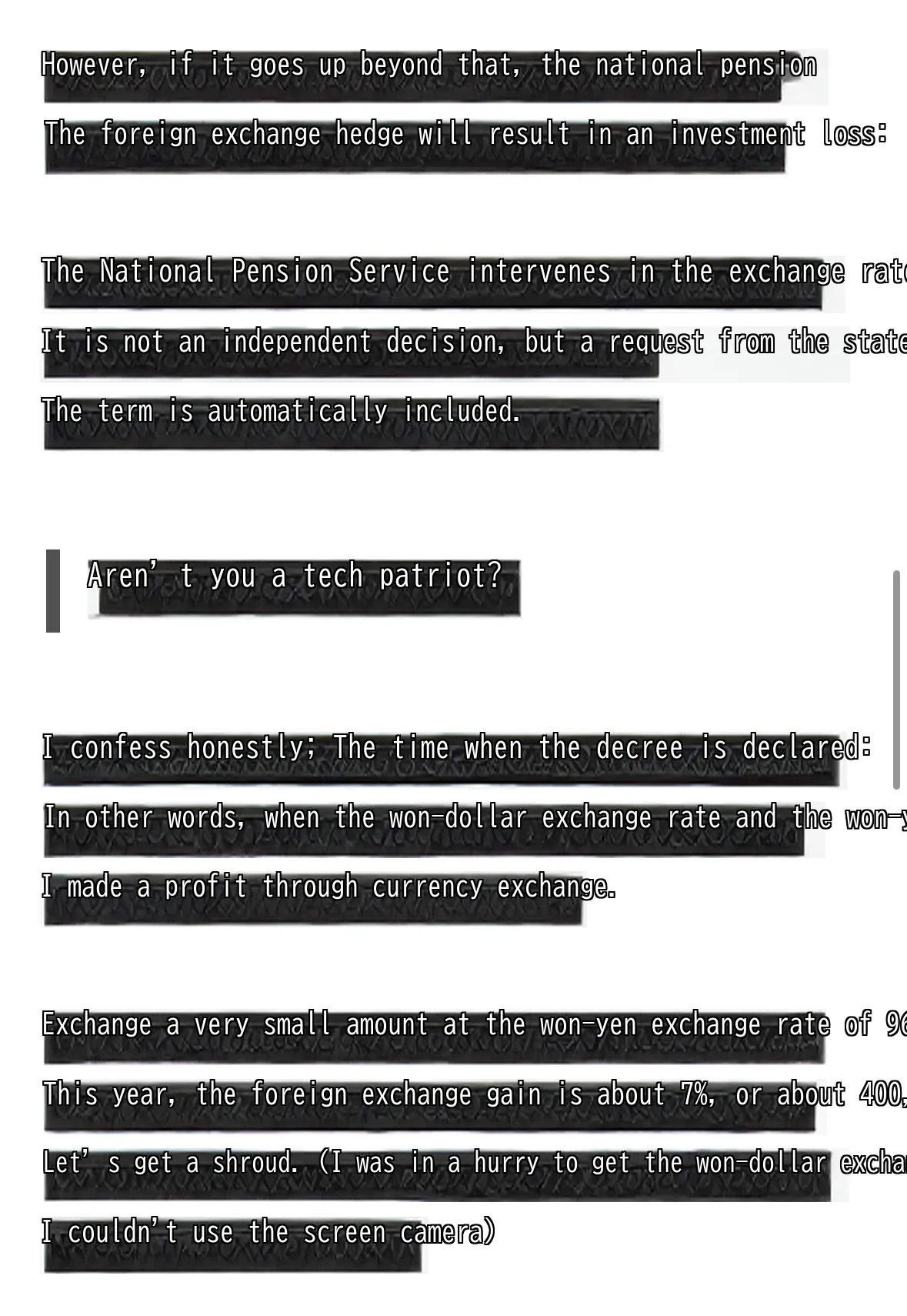

From 1,470 won or more, exchange rate protection begins with national pension.

The future of the country is being melted and discussed in a room.

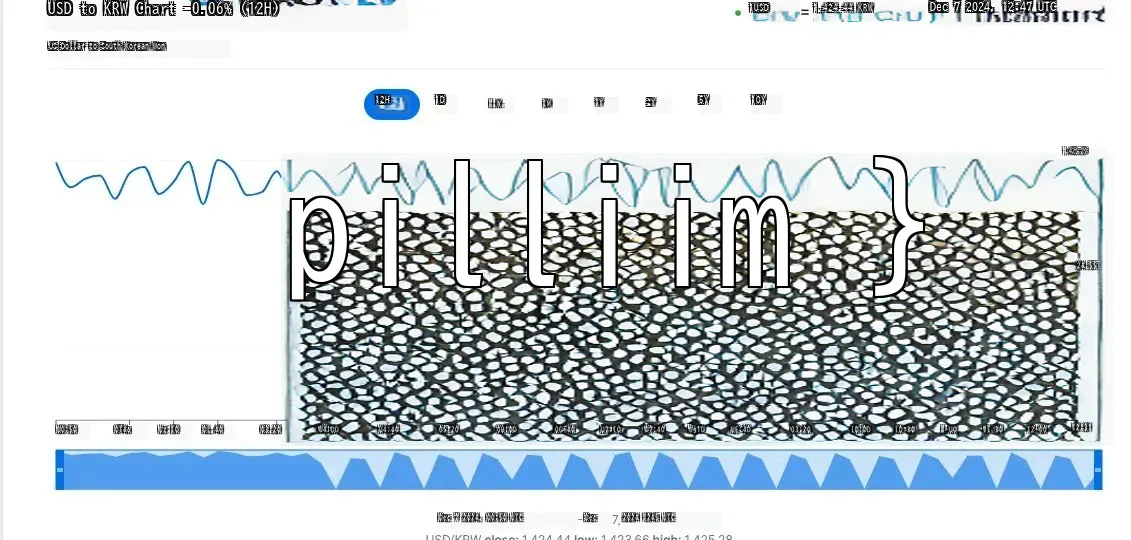

USD to KRW Chart -0.06% (12H)

image text translation

1USD

1,424.44 KRW

Dec 7 2024, 12:47 UTC

US Dollar to South Korean Won

12H

1D

I.W.

IM

1Y

2Y

5Y

1OY

1,425.29

24.55

pilliim }

UO:50

OT4o

Uz:IO

DL.40

03.20

U4.DD

U4:40

05.20

0B:0D

0G-40

U7:IO

D7:40

Ug1U

UE:4D

03:20

ID:DD

ID:30

I-UO

II 30

12-00

Dec 7 2024, O0;50 UTC

Dec

2024 1245 UTC

12:31

!