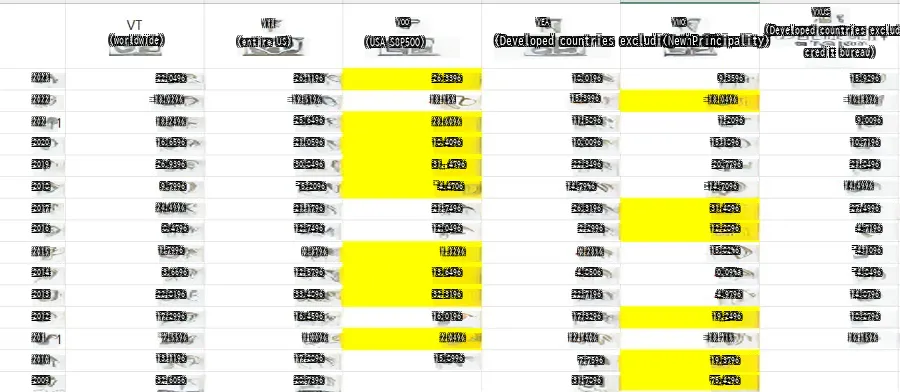

We compared Vanguard’s 6 ETFs.

The source of the rate of return is Vanguard’s official website.

According to the Vanguard website, VOO was launched in mid-2010.

VXUS appears to have been listed in 2011.

image text translation

VXUS

VTI

VOO

VEA

VWO

(Developed countries excluding the US)

(worldwide)

(entire US)

(USA S8P5OO)

(Developed countries excluding the US)

(New Principality)

credit bureau)

2023

22.0496

26.1196

26.3396

18.0196

9.3596

15.9296

2022

-18.0296

-19.5196

18.159

-15.3996

-18.0496

-16.1396

202

18.2496

25.6496

28,6096

11,5896

1,2096

9.0096

2020

16.6596

21.0596

18.4096

10.0096

15.1896

10.7196

2019

26.9396

30.8496

31,.4796

22.3496

20.7796

21.8496

2018

9.7996

~5.2096

‘4.4706

14.79%6

:14.7096

14.4996

2017

24.4996

21.1796

21.7496

26.3196

31.4896

27.4996

2016

8.4796

12.7496

12.0496

2.2996

12.2896

4.7196

2015

1.7996

0.3796

1,3296

0.28%6

-15.82%6

~4.1096

2014

3.6696

12.5796

13.6496

4.8506

0.09%a

~4.8496

2013

22.8196

33.4896

32.3196

22,7196

4.9796

14.8796

2012

17.2996

16.4596

16,0196

17,3296

19,2496

18.2796

201

~7.5596

1.0096

2.0496

12.1406

-18.71%

16.1596

2010

13.1196

17.2896

15.8996

7,7596

19,3796

2009

32.6056

28.7396

31,7896

75,4296

Surprisingly(?) over the past 15 years

Looking at the comparison between US and emerging market yields

America is 9th

Emerging countries appear to be ahead 6 times.

Well, 2022 and 2016 are narrow victories for emerging countries…

What’s unfortunate about this is that in our country,

Developed countries excluding the US (VEA)

Emerging Markets (VWO)

Excluding the US, developed countries + emerging countries ETF (VXUS) does nothing well.

Even if VEA VWO cannot be made, it seems there will be demand for VXUS if domestic asset management companies make it…

For VT, if you buy TDF2050 Active listed on Samsung Assets (KODEX), it contains more than 70% of VT, so you can buy it with that.

Rather than buying a VT while paying currency exchange fees, overseas stock fees, and capital gains tax when selling, you can save on such fees by buying from a savings account such as an ISA or IRP.

suggestion

0

share