Google Korea’s first sales this year were 21 billion won.

Operating profit was 15.5 billion won.

However, this amount is only the tip of the iceberg.

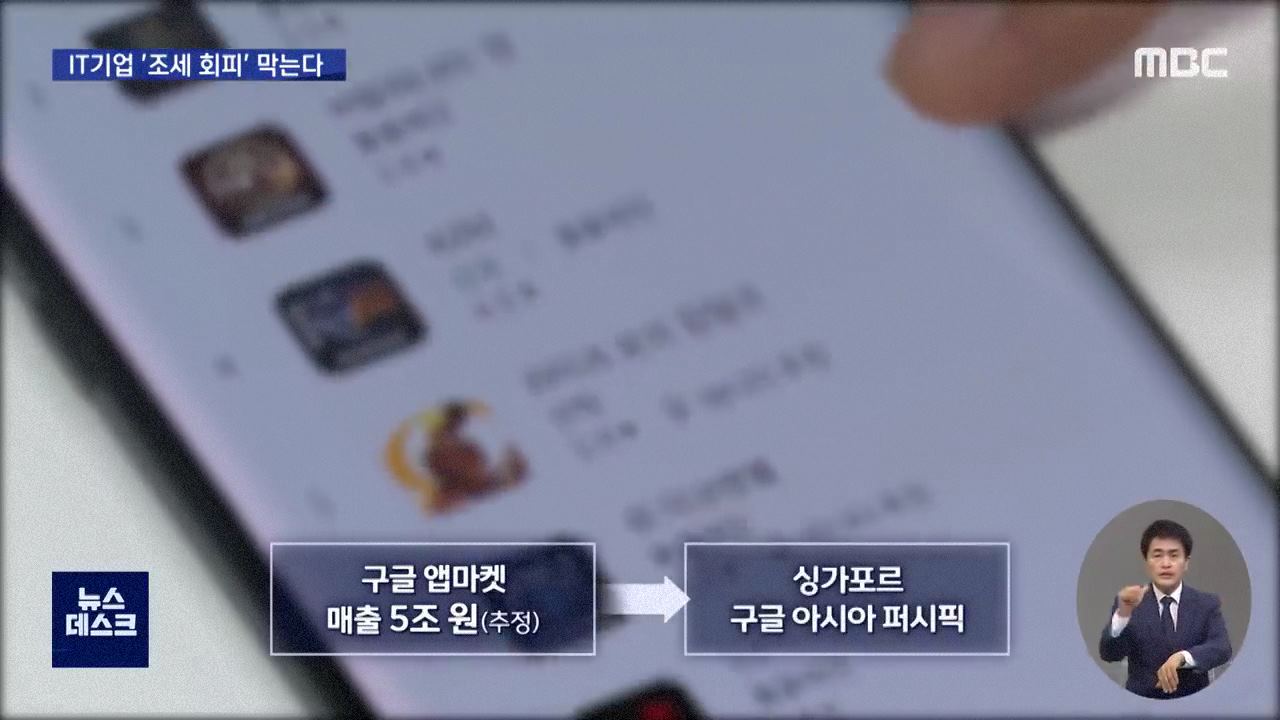

Google Korea’s revenue from the app market in Korea last year is estimated to be 5 trillion won, all of which are located in Singapore!Google Asia Pacific! It’s been caught by sales.

It’s not yesterday or today that a global IT company has set up a corporation in a place with a low corporate tax rate to reduce taxes.

Because of the current system of taxing where corporations are located.

But this tax avoidance will be difficult in the future.Treasury ministers from seven major countries issued a joint statement to raise corporate tax rates in 130 countries around the world to at least 15 percent.

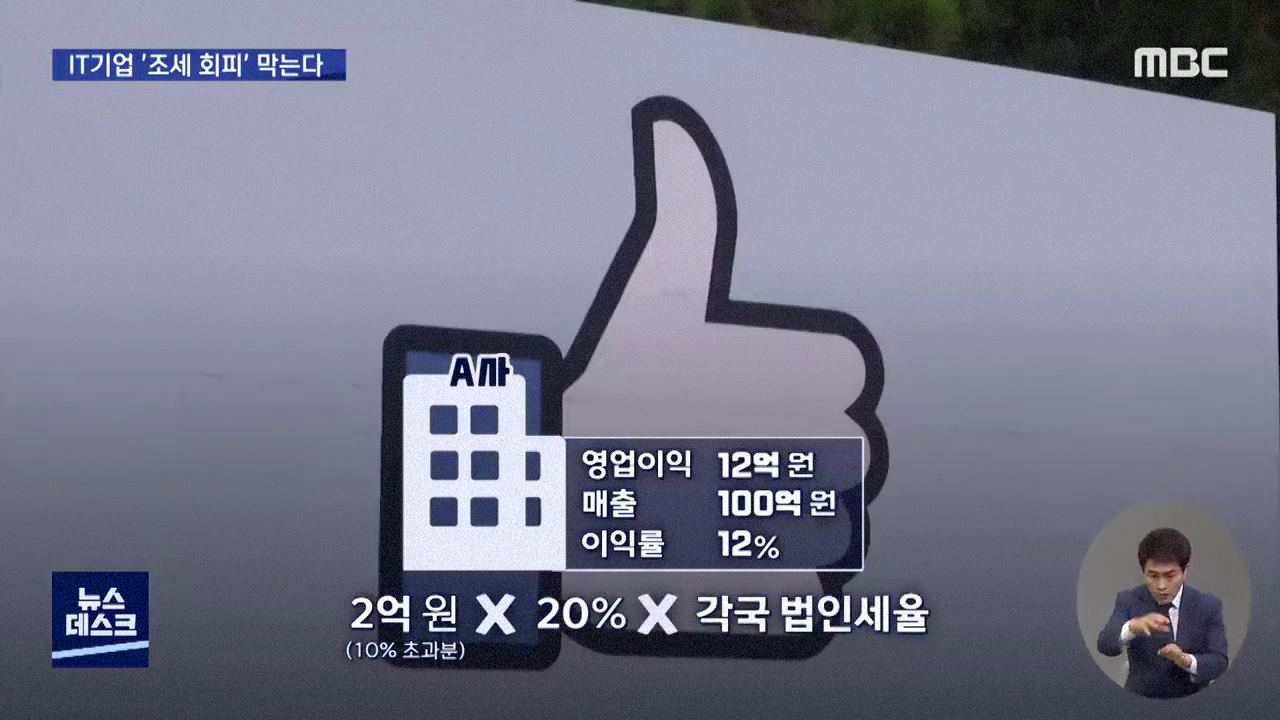

If a company with sales of 10 billion won has an operating profit of 1.2 billion won, 20% of 200 million won, excluding 10% of operating profit, agreed to impose corporate tax in the country in which it operates.

This will allow the Korean government to directly tax Google, Facebook, and Netflix, which have high operating profits in Korea.

The key is the standard of taxable enterprises.

The U.S. and the EU are coordinating on standards, and there is a possibility that Samsung Electronics, the world’s 15th largest market capitalization, will be included in Korea.

The issue of corporate tax on IT companies will be finalized in October after the G20 and OECD meetings.