image text translation

(1)common sense of inheritance/gift tax

(2)inheritance/gift

(3)bewildered

(4)agony over inheritance tax

(5)I’ll let you go

(1)common sense of inheritance/gift tax

image text translation

(2)Q11 What kind of inheritance tax is it

(3)Recently, my father passed away suddenly I’ve been told around me that I have to report inheritance tax, but I don’t know what inheritance tax is and how much of my father’s wealth is, so I wonder what to do

(4)The inheritance tax is paid by the bereaved family on the property of the deceased

(5)In order to file an inheritance tax, it is important to identify all property, such as a home car stock deposit owned by the late heir And inheritance tax is calculated by subtracting debt from the heir’s property, so you also need to know the heir’s debt, such as loan credit card payments, unpaid taxes, unpaid hospital bills

(6)In addition to the debt, the law requires you to subtract a certain amount more, which is called an inheritance deduction If you make good use of the inheritance deduction, you can further reduce the inheritance tax Q3 Q5 will tell you more about the inheritance deduction

(7)a frequent term for inheritance tax

(8)Property left by the heir of the bereaved family who inherits the estate of the deceased

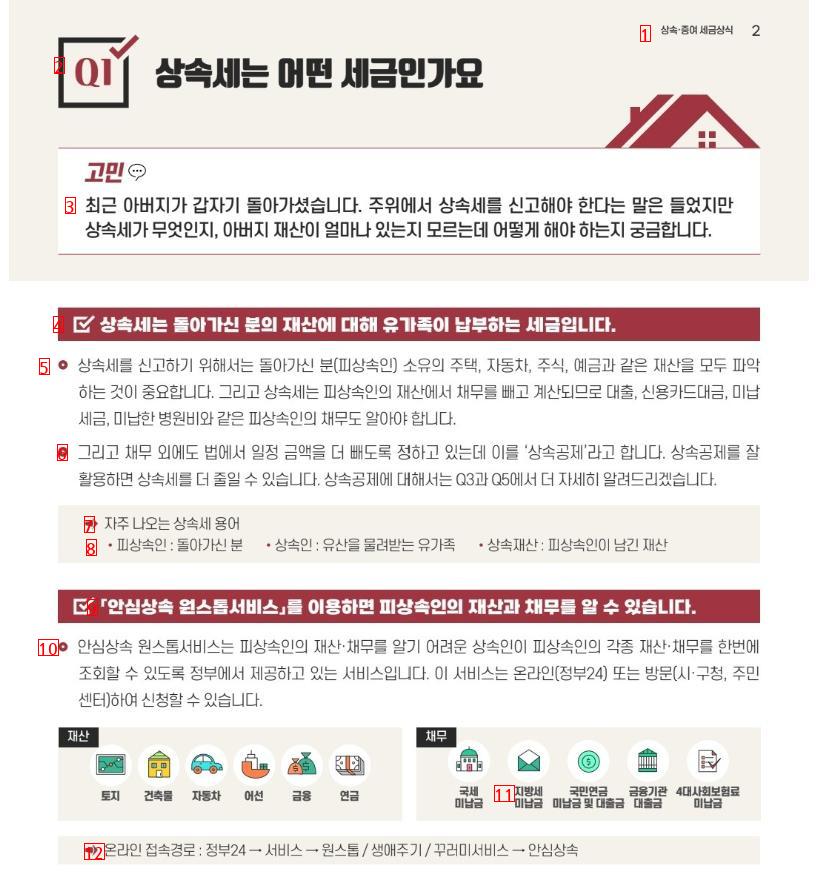

(9)You can find out the property and debt of the heir by using the Safe Inheritance One-Stop service

(10)The Safe Inheritance One-Stop Service is a service provided by the government that allows heirs who have difficulty in knowing the heir’s property and debt to inquire about the heir’s various property and debt at once You can apply for this service by visiting the online government 24 or by visiting the community service center of the district office

(11)Four major local tax financial institutions: Social insurance premiums, unpaid national pension payments, and loans

(12)Online access route Government 24 → Service – One-stop life cycle package service Secure inheritance

(1)common sense of inheritance/gift tax

image text translation

(2)Is there anything else you need to know other than what you inherited

(3)I think there is no inheritance tax because I inherited only low-priced houses from my father, but I wonder if there is anything else I need to find out other than the property my father inherited

(4)We need to see if the heir has any property he gave while he was alive

(5)This is because the inheritance tax is calculated by adding up the inherited property inherited at the time of death and the property donated by the heir to another person during their lifetimeAt this point, not all the gifted property is added, but the property donated to the heir within 10 years and the property donated to another person who is not the heir within 5 yearsGift tax paid at the time of donation is deducted from inheritance tax

(6)We also need to know more of the heir’s retirement and death insurance

(7)The heir’s retirement and death insurance payments are often received by the heir At this time, it is easy to think that the money is not inherited because the heir directly receives it from the company or insurance company, but retirement and death insurance are also included in the inherited property

(8)If the heir withdraws the deposit before death, they need to know where to use it

(9)The National Tax Service can check financial information and find out the details of the heir’s deposit withdrawal If the heir withdraws more than 200 million won or 500 million won in deposits within one year or two years before the date of death, but it is unclear where they are used, a certain amount is included in the inherited property. This is because there are many cases of intentional withdrawal of deposits during life to reduce inheritance tax

(10)· If the cost of using cash is proven to be equivalent to hospital expenses, it is not included in the inherited property, so it is recommended to carefully record the details of the use of cash

(11)Example One year ago, out of KRW 1 billion in deposits, KRW 500 million was confirmed to have purchased real estate. The remaining KRW 500 million is unclear where it was used

(12)Amount included in the inherited property Unclear where to use – min withdrawal KRW 22.2 billion = 500 million won – min 1 billion × 20.2 billion = 300 million won

(13)In addition to withdrawing deposits, the same method is applied to the inherited property if a loan is received or real estate is disposed of

(1)common sense of inheritance/gift tax

image text translation

(2)Is there an inheritance tax

(3)I inherited a house where my late father lived People around me say that there is no inheritance tax of up to 1 billion won in property, but I wonder if that’s right

(4)Even if you inherit a house worth 1 billion won

(5)Depending on the composition of the heir, you may or may not pay inheritance tax

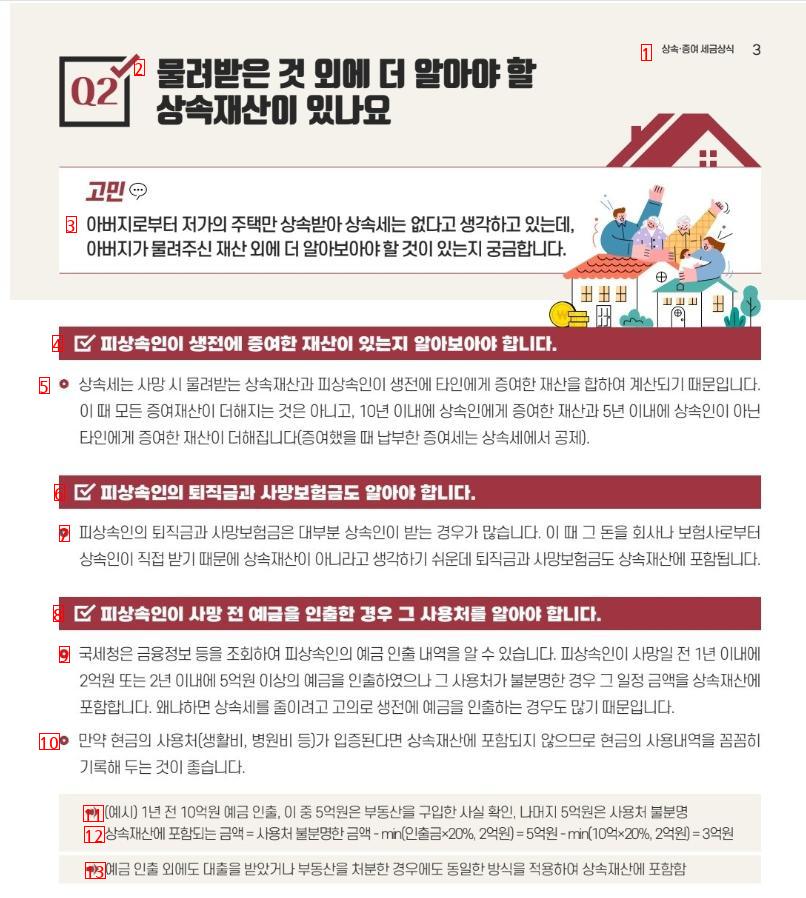

(6)As I told you in Q1, inheritance tax is calculated by subtracting debt and inheritance deduction from the inherited property of the heir. Therefore, if there is no remaining amount when deducting debt and inheritance deduction from the inherited property, there is no inheritance tax

(7)However, the inheritance deduction depends on who the heir is. For example, if you have both a spouse and children, at least one billion won will be deducted That’s why many people say that if you inherit less than 1 billion won, you don’t get an inheritance tax

(8)· However, if you only have a spouse or children, the deduction amount will be reduced, so even if you inherit the same house worth 1 billion won, you may incur inheritance tax

(9)When you have a spouse and children, when you only have a spouse, when you only have children

(10)Deduction amount KRW 1 billion KRW 3.5 billion KRW Deduction amount KRW 700 million KRW 3.2 billion KRW Deduction amount KRW 500 million KRW

(11)500 million won basic deduction 500 million won spouse deduction 500 million won to 3 billion won basic deduction 200 million won spouse deduction 500 million won to 3 billion won spouse deduction

(12)500 million won in basic deduction

(13)In addition, there are various deduction systems such as financial property deductions of up to 200 million won, family business inheritance deductions, so please make the most of them

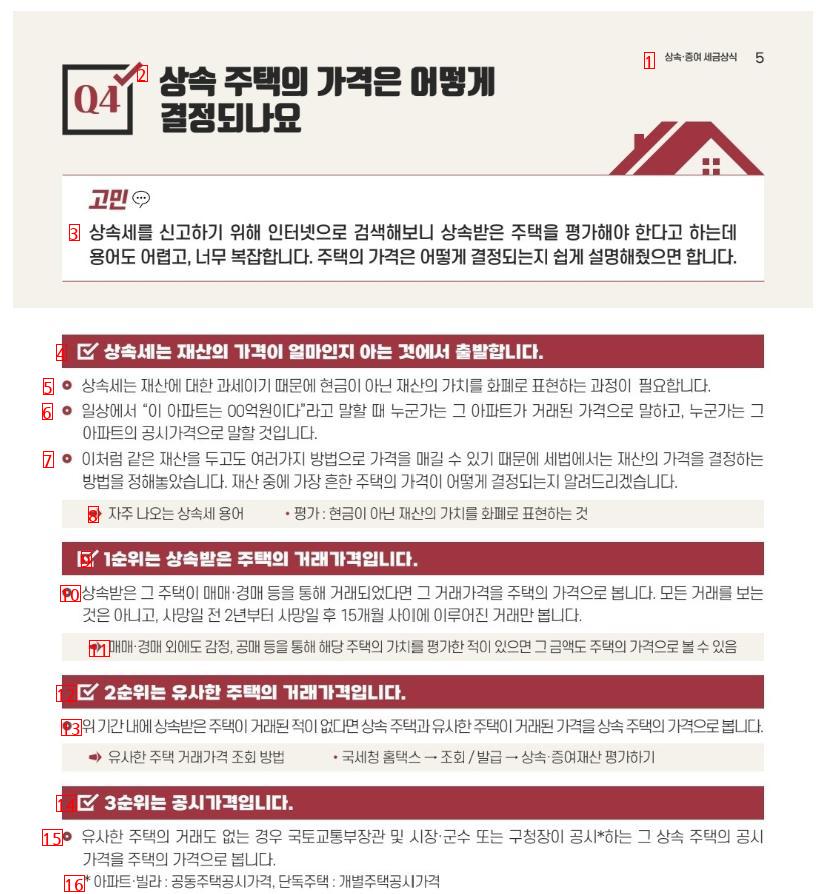

(1)Inheritance/gift tax common sense 5

image text translation

(2)What is the price of the inheritance house determined

(3)When I searched on the Internet to report inheritance tax, they said that the inherited house should be evaluated, but the terminology is difficult and too complicated I want you to explain easily how the price of a house is determined

(4)c The inheritance tax starts with knowing how much the property costs

(5)Since inheritance tax is a tax on property, it is necessary to express the value of property in currency, not cash

(6)In everyday life, when you say this apartment is KRW 60 billion, someone will say it’s the transaction price, someone will say it’s the official price of the apartment

(7)Because you can price the same property in many ways, the tax code has set out how to determine the price of the property Let me tell you how the price of the most common property is determined

(8)Evaluating the terminology of inheritance tax that is frequently expressed in currency the value of property, not cash

(9)Number one is the transaction price of the inherited house

(10)If the inherited house was traded through a sale auction, etc., the transaction price is considered the price of the house I don’t look at all the transactions, I look at only the transactions that were made between two years before the date of death and 15 months after the date of death

(11)In addition to the sale auction, if the value of the relevant house has been evaluated through an appraisal public sale, the amount can also be regarded as the price of the house

(12)The second priority is the transaction price of similar houses

(13)If the inherited house has never been traded within the above period, the price at which the house similar to the inherited house is traded is regarded as the price of the inherited houseSimilar housing transaction price inquiry method National Tax Service Hometax → Inquiry issuance → Evaluate inherited/donated property

(14)c 3rd place is the official price

(15)If there is no transaction of a similar house, the official price of the inherited house announced by the Minister of Land, Infrastructure and Transport and the head of the Si/Gun or the head of the Gu shall be regarded as the price of the house

(16)Apartment/Villa Apartment House Public Price Individual House Public Price

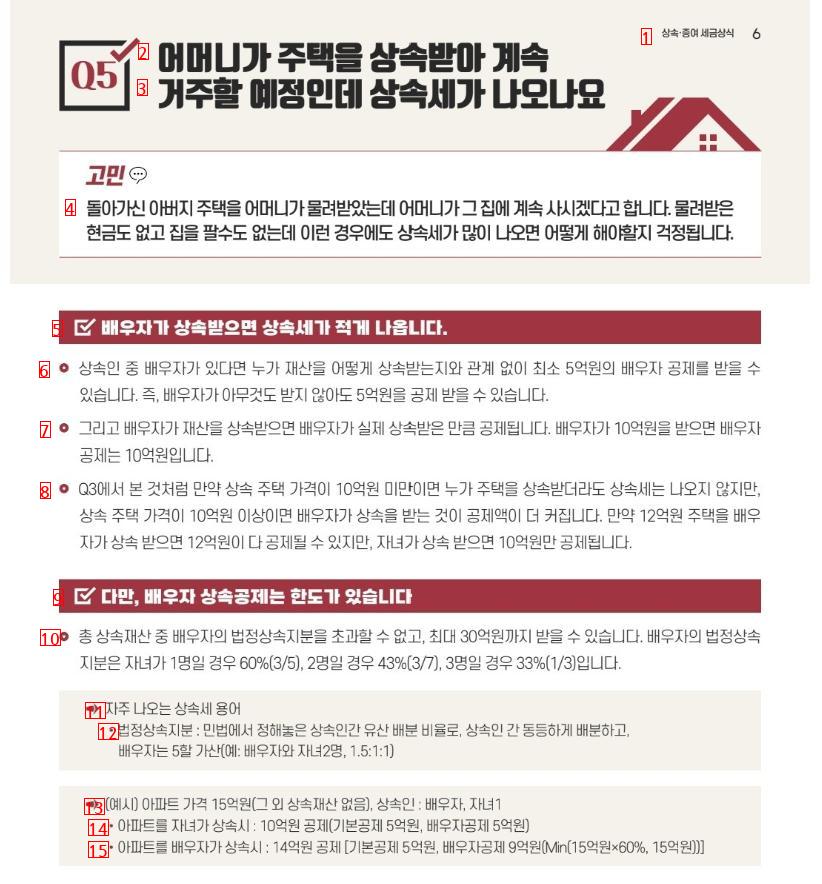

(1)common sense of inheritance/gift tax

image text translation

(2)My mother inherited the house

(3)I’m going to live, but will I get inheritance tax

(4)My mother inherited my late father’s house, and she said she would continue living there I don’t have the cash I inherited and I can’t sell my house, but even in this case, I’m worried about what to do if I get a lot of inheritance tax

(5)If more spouses inherit, the inheritance tax will be lower

(6)○ If you have a spouse, you can get a minimum of 500 million won in spouse deductions regardless of who inherits the property. In other words, you can get a 500 million won deduction even if your spouse doesn’t get anything

(7)And if the spouse inherits the property, it’s deducted as much as the spouse actually inherited it If a spouse receives 1 billion won, the spouse deduction is 1 billion won

(8)As we saw in Q3, if the price of the inherited house is less than 1 billion won, there is no inheritance tax no matter who inherits the house, but if the price of the inherited house is more than 1 billion won, the deduction amount is higher for the spouse to inherit If a spouse inherits a house worth 1.2 billion won, all 1.2 billion won can be deducted, but if a child inherits it, only 1 billion won will be deducted

(9)c However, there is a limit to the spouse inheritance deduction

(10)· Of the total inherited property, the spouse’s legal inheritance cannot be exceeded and can receive up to 3 billion won The legal inheritance interest of a spouse is 3313 for 60352 children, 43373 children

(11)a frequent term for inheritance tax

(12)The legal inheritance share is equally distributed among heirs at the ratio of inheritance distribution among heirs prescribed by the Civil Act, and the spouse is 50% more than the spouse and two children 1511

(13)Example apartment price of 1.5 billion won. No other inherited property. Inheritor’s spouse’s child 1

(14)When a child inherits an apartment, the basic deduction of 1 billion won, the basic deduction of 500 million won, and the spouse deduction of 500 million won

(15)When a spouse inherits an apartment, the basic deduction of 1.4 billion won, the basic deduction of 500 million won, the spouse deduction of 900 million won, Min1.5 billion won × 601.5 billion won

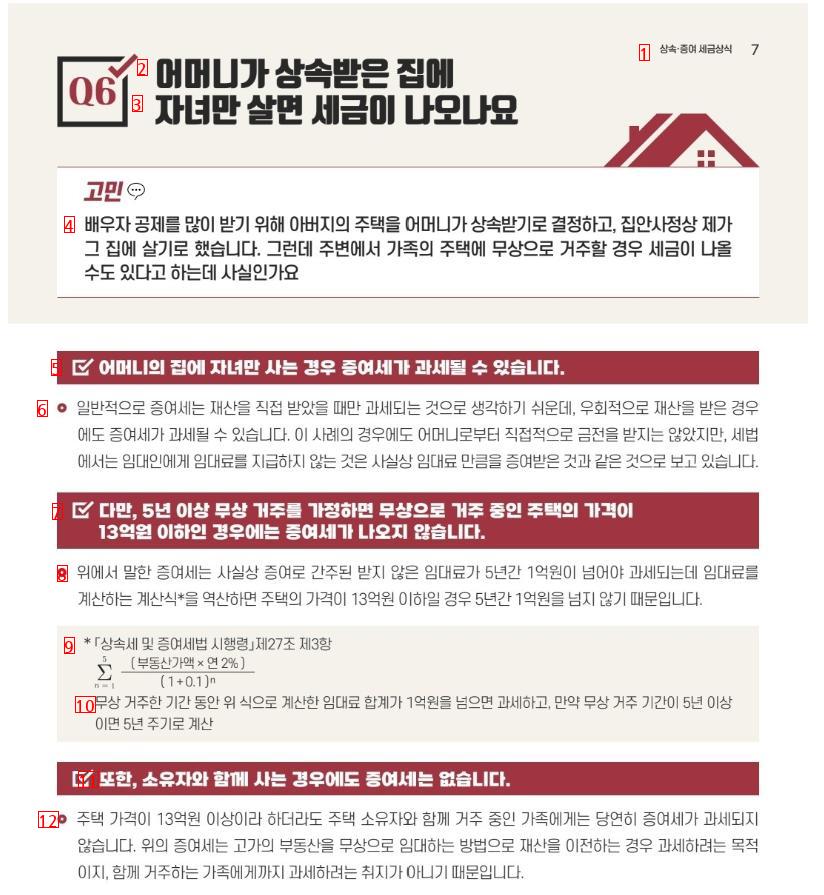

(1)Inheritance/gift tax common sense

image text translation

(2)In the house my mother inherited

(3)Do I get taxes if I live with my children

(4)My mother decided to inherit my father’s house in order to get a lot of spouse deductions, and I decided to live in that house However, people around me say that if you live in your family’s house for free, you may incur taxes. Is it true

(5)Gift tax may be levied if only children live in the mother’s house

(6)○ In general, it is easy to think that gift tax is levied only when you receive your property directly, but gift tax may also be levied if you receive your property indirectly In this case, I didn’t receive money directly from my mother, but the tax law believes that not paying rent to the landlord is actually the same as receiving the rent

(7)However, if you assume a free residence for more than 5 years, you will not receive gift tax if the price of the house you live for free is less than 1.3 billion won

(8)The gift tax mentioned above is actually taxed only when the unreceived rent considered a gift exceeds 100 million won over five years, but if the calculation formula for calculating the rent is inverted, the price of the house does not exceed 100 million won over five years

(9)Article 27 (3) of the Enforcement Decree of the Inheritance Tax and Gift Tax Act

(10)If the total rent calculated by the above formula exceeds 100 million won during the period of free residence, it shall be taxed, and if the period of free residence is more than five years, it shall be calculated every five years

(11)Also, there is no gift tax if you live with the owner

(12)Even if the price of the house is more than 1.3 billion won, gift tax is of course not levied on families living with homeowners This is because the above gift tax is intended to tax property by renting expensive real estate free of charge, not to tax families living together

(1)common sense of inheritance/gift tax

image text translation

(2)I live with my late father

(3)I took over the house when my father died while we were living together and supporting him In this case, I wonder if there are any tax benefits

(4)If you support the heir, you can receive the inheritance deduction for the house you live with

(5)If you meet the requirements below, you can deduct up to 600 million won from the price of the house you lived with the heir For example, if the price of a house you lived with is 500 million won, the entire 500 million won will be deducted, and if it is 1 billion won, only 600 million won will be deducted

(6)All requirements ① You must live in one household and one house for more than 10 years

(7)Even if you are inevitably unable to live continuously due to military service, etc., you can deduct if you have lived together for more than 10 years by adding up the total period However, the period during which your child was a minor is excluded

(8)5 years 5 years = 10 years in total

(9)※ In addition to military service, it is also possible to live separately due to academic and workplace care

(10)When judging one household and one house, it includes the period of being homeless, and if you temporarily own two houses, it also includes the period of temporary two houses

(11)Buy A house B Buy A house Transfer A house

(12)8 years and 2 years = Total 10 years and 6 years and 2 years = Total 10 years

(13)- 1 house for 6 years. Temporary 2 years. – 1 house for 2 years. 8 years. 1 house for 2 years

(14)a temporary two-house house

(15)A case where a new house is inevitably purchased for the purpose of transferring a house, etc. and becomes a two-house. At this time, if the previous house is transferred within two years, it is included in the period of cohabitation

(16)ㄷ Requirement ② Children living with the heir must inherit the house

(17)At this time, even if a child living together inherits part of the house, the amount equivalent to the stake is deducted For example, if a child living together inherits 500,000 out of a billion won house, 500 million won can be deducted

(18)· Even if the spouse lives with the heir, the inheritance deduction for cohabitation housing does not apply

(1)common sense of inheritance/gift tax

image text translation

(2)If you inherit a house, the second homeowner

(3)Do I have to pay the taxes

(4)I was a single homeowner and never paid comprehensive real estate taxes, so I didn’t worry about comprehensive real estate taxesHowever, as one house is suddenly inherited, I am worried that I may have to pay comprehensive real estate taxes as a second homeowner

(5)One homeowner will be retained for five years after inheritance

(6)○ Therefore, a single homeowner who did not pay the comprehensive real estate tax does not pay the comprehensive real estate tax immediately after inheritance However, after five years, you may become a two-home owner and have to pay comprehensive real estate taxes, so if you are worried about comprehensive real estate taxes, it is better to organize your house before that

(7)If you inherit a house in a more rural area, it may not add up to the number of houses

(8)The Comprehensive Real Estate Tax Act excludes houses outside the metropolitan city of special autonomy with an official price of less than 300 million won from the number of houses Therefore, if a single homeowner inherits a low-cost house in these provinces, he or she will continue to become a single homeowner without a period limit

(9)Some towns and villages in special autonomous cities or metropolitan cities are exceptionally low-cost housing in local areas

(10)For more information, see Article 4-2 (3) of the Enforcement Decree of the Comprehensive Real Estate Tax Act

(11)c. If you inherit jointly with another heir, it depends on the share and the value

(12)If the inherited part is less than 40 million won or the value of the inherited part is less than 600 million won or less than 300 million won for houses outside the metropolitan area, the existing one-home owner will continue to be maintained On the contrary, if the inheritance exceeds 40 and the value exceeds 600 million won or 300 million won, it is added to the number of houses, so in five years, it becomes a second-home owner

(13)※ It is assumed that the heir’s existing house and the heir’s house are each one, and in other cases, the above explanation does not apply

(1)Inheritance/gift tax common sense 10

image text translation

(2)Out of the existing and inherited houses

(3)Which one should I transfer

(4)I don’t need two houses, so I’m going to transfer one of them Considering taxes, I wonder if it’s better to sell the existing house or the inherited house first

(5)It’s tax advantage to transfer more existing homes first

(6)Let me explain the general method of calculating capital gains tax first When a one-family homeowner transfers a house, only more than 1.2 billion won of high-priced housing will be taxed, and a second-family homeowner will be subject to capital gains tax no matter what house they transfer But there are a few exceptions For example, in the case of a temporary two-house, if the existing house is transferred within three years, it will not be taxed In addition, when inheriting a house and transferring an existing house, there is no capital gains tax regardless of the period

(7)However, in order to be exempt from capital gains tax as above, existing houses must meet tax-free requirements

(8)Non-taxation requirements for capital gains tax

(9)①If a house is located in the area subject to adjustment at the time of acquisition of possession for at least two years, reside for at least two years

(10)The housing price is less than 1.2 billion won

(11)For example, if you have only acquired an existing house for a year, you must hold it for an additional year after inheritance and transfer it to receive tax-free benefits

(12)c. The same is true if you are jointly inherited with another heir

(13)○ All co-inherited heirs are tax-free if they transfer existing homes that meet tax-free requirements first, and taxed if they transfer inherited house shares first

(14)※ It is assumed that the heir’s existing house and the heir’s house are each one, and in other cases, the above explanation does not apply

(1)common sense of inheritance/gift tax

image text translation

(2)How do you report inheritance tax

(3)Do you pay

(4)I wonder how I can report inheritance tax I’ll inherit the real estate

(5)It’s hard to pay in cash at once, so I need your help

(6)You can report the inheritance tax to the tax office that has jurisdiction over the address of the heir

(7)○ Not all heirs need to report it, but one of the heirs needs to report it If it is difficult to visit, you can report it online Additional taxes may be imposed after the reporting deadline, so it’s better to report within the deadline

(8)Within six months from the end of the month in which the deadline for reporting death falls

(9)For example, the reporting deadline for death on the 41st is 1031 days, and the reporting deadline is 1031 days even for death on the 428th

(10)Online reporting channel National Tax Service Hometax → Report Payment – Inheritance Tax

(11)Heirs who lack more cash to pay can use the installment and annual payment system

(12)· The installment payment is a method of paying a portion of the tax when reporting and the remaining tax in two months. The amount due when reporting depends on the total tax If the total tax is between 10 million won and 20 million won, if the total tax is more than 20 million won, at least 50 of the total tax shall be paid immediately

(13)Annual pension is a method of paying a certain amount every year and can be divided over a maximum of 10 years If you choose to pay ten-year annuity, you will pay 111 of the total amount immediately when reporting and the remaining 1011 will be divided into annual payments Unlike annual payments, you must provide collateral to the National Tax Service and interest is added

(14)The total amount of the installment payment example is 40 million won, 2341 days, and reported on the 231031 days of death

(15)Pay more than 20 million won while reporting on the 231031st and pay the remaining tax by the 1231st

(16)Total annual payment of 60 million won, 2341 days of death, 5 years of choice

(17)Pay 10 million won while reporting on the 231031th and pay 10 million won in interest every year for 24 to 28 years

(1)Inheritance gift tax common form 12

image text translation

(2)Inheritance/gift tax common sense

(3)Inheritance and gift tax TMI

(4)Fact-checking by the IRS

(1)Inheritance and gift tax common sense 13

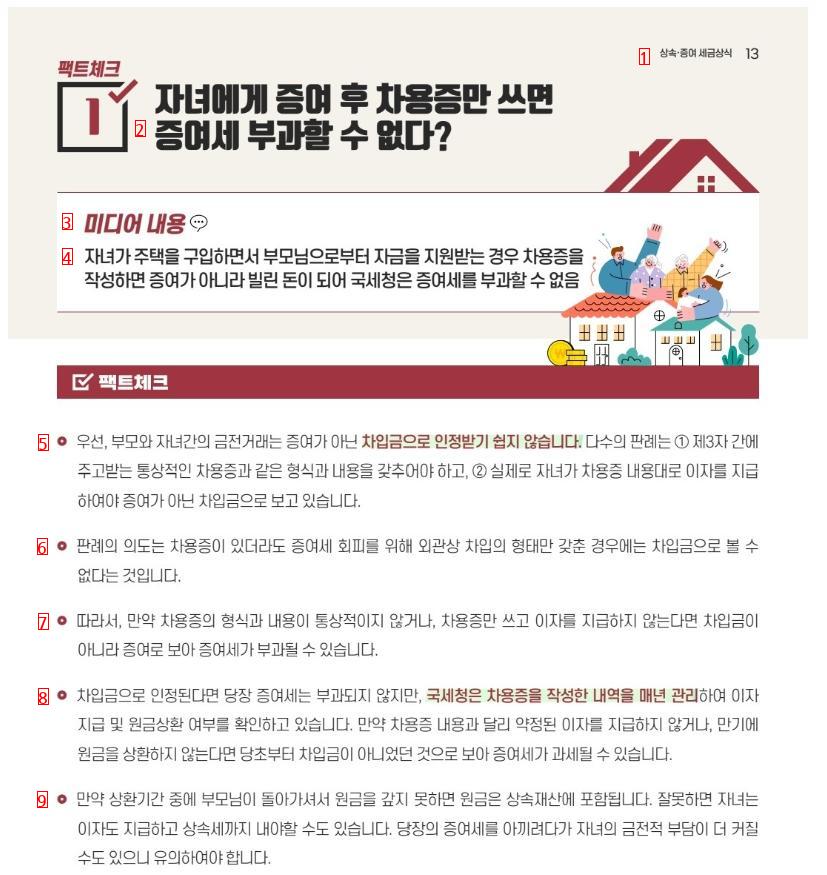

image text translation

(2)can’t impose gift tax

(3)Media Content

(4)If a child receives funding from his or her parents while purchasing a house, the IOU becomes borrowed money, not a gift, and the National Tax Service cannot impose gift tax

(5)First of all, it is not easy to recognize financial transactions between parents and children as borrowings, not gifts Many precedents are based on the same format and contents as ordinary IOUs exchanged between third parties, and in fact, children must pay interest according to the contents of the IOUs to be regarded as borrowings, not gifts

(6)The intention of the precedent is that even if you have a loan certificate, it cannot be regarded as a loan if you only have a form of external borrowing to avoid gift tax

(7)○ Therefore, if the form and contents of the loan are not ordinary or if you only use the loan and do not pay interest, gift tax may be imposed based on gift, not borrowing

(8)○ If it is recognized as a loan, there is no gift tax right away, but the National Tax Service manages the details of the loan every year to check whether interest payments and principal payments are made Unlike the contents of the loan certificate, if the agreed interest is not paid or the principal is not repaid at maturity, gift tax may be levied as it was not borrowed from the beginning

(9)If your parents die during the repayment period and you can’t pay back the principal, the principal will be included in the inherited property If you do something wrong, your child may have to pay interest and pay inheritance tax If you try to save the gift tax right now, your child’s financial burden may increase, so be careful

(1)Inheritance and gift tax common sense 14

image text translation

(2)Acts and subordinate statutes, interpretation cases, etc

(3)Article 4 of the Inheritance Tax and Gift Tax Act is subject to gift tax

(4)① Gift tax shall be imposed on gifted property falling under any of the following subparagraphs in accordance with this Act: 1 Property or profit transferred free of charge

(5)Seomyeon Team 4-103620040707

(6)In this case, if you borrow funds from your mother and use them as real estate acquisition funds, the head of the relevant tax office will investigate specific facts and decide whether to view the amount as a gift or as a loan under the consumption loan contract, and in principle, we do not recognize consumption loans between lineal survivors and descendants

(7)Seoul High Court 2014NU51236201120

(8)The Plaintiff is responsible for proving that the Plaintiff borrowed money rather than receiving a gift from his father, but it is insufficient to recognize it as a contract for borrowing entities, such as no specific explanation such as the repayment period or interest agreement under the money consumption loan contract

(9)Busan District Court 2020 Guhap 20355 20201210

(10)Since it is merely the appearance of the payment of the transfer of the above real estate by borrowing the form of a money consumption loan contract that is not normally possible among general trading parties, such a money consumption loan contract can be denied according to the principle of real taxation as it is an act of disguise or tax avoidance, and the plaintiff’s parents paid the principal and interest to the plaintiff as the above real estate rental incomeAlternatively, taxes on the plaintiff’s interest income were paid accordinglyTherefore, it cannot be said that there is the substance of the above loan for money consumption

(1)Inheritance and gift tax common sense 15

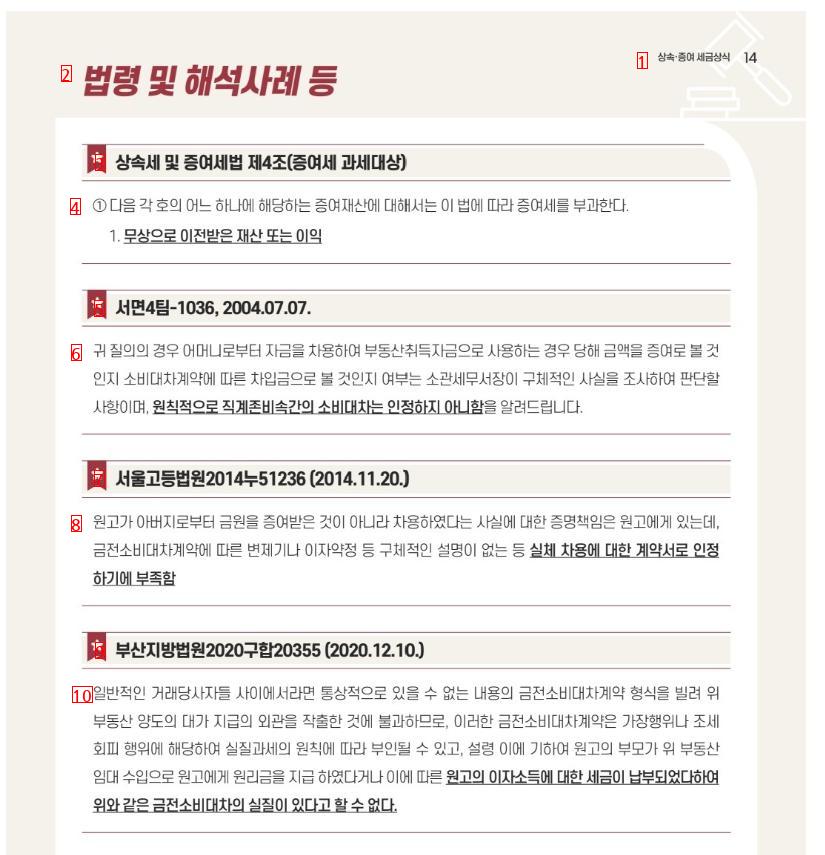

image text translation

(2)Life insurance money with children as policyholders

(3)Media Content

(4)When a father subscribes to life insurance, he/she often has a child who receives the insurance, and at this time, inheritance tax is levied if the policyholder is himself/herself, but inheritance tax is not levied if the policyholder is a child with income

(5)Inheritance tax, whether the policyholder’s father’s insurance is taxed or not, inheritance tax x

(6)premium payer insurance payer

(7)policyholder

(8)Inheritance tax zero premium payer

(9)Even if the policyholder is a child, if the father actually pays the insurance premium, the insurance money received due to the death of the father is included in the inherited property

(10)Insurance payer = Insurance payer

(11)Inheritance tax X

(12)If a child subscribes to insurance and pays insurance premiums directly in order to prepare for the inheritance tax to be paid in advance when the father dies, the insurance money paid is not included in the inherited property

(13)Some media are using this to promote that inheritance taxes can be reduced by pretending that the child has paid the insurance while the father actually pays the insurance, which is not tax savings, but apparent tax evasion If intentional tax evasion is revealed through an inheritance tax investigation, etc., it may be a greater burden, so be careful

(1)Inheritance and gift tax common sense 16

image text translation

(2)Acts and subordinate statutes, interpretation cases, etc

(3)Insurance money deemed to be inherited property under Article 8 of the Inheritance Tax and Gift Tax Act

(4)① Life insurance or non-life insurance received due to the death of the heir, and what the heir receives under the insurance contract, which is the policyholder, shall be deemed inherited property

(5)② Even if the policyholder is not the heir, if the heir actually pays the insurance premium, paragraph (1) shall be applied by considering the heir as the policyholder

(6)Property Tax Division-256 20100429

(7)Under Article 8 of the Inheritance Tax and Gift Tax Act, insurance money for life insurance or non-life insurance paid due to the death of the heir, even if the policyholder who became the policyholder is the heir’s person, the insurance money paid by the heir shall be regarded as inherited property

(8)Suwon District Court-2016-Guhap-6718020170725

(9)As previously seen, the fact that the Plaintiff paid the insurance payment for the issue insurance, which is a part of the sale price paid after selling the real estate in this case, is that the Plaintiff paid the issue insurance payment, which was made up of the contractor and the beneficiary of the insurance, and according to this, the Plaintiff is considered to have received the issue money from the 2011025 Shim ○○

(10)Examination Inheritance 2013-0004 20130521

(11)The details of the issue insurance money extracted by the Disposal Administration are as follows: ○○ Insurance 1 ○○ Insurance 2 The contractor and the beneficiary of maturity are the claimant, and the insured is the heir, ○○ Insurance 3 ○○ Insurance 5 ○○ All insured persons of the contractor and maturity beneficiaries of insurance are identified as heirs There seems to be no other fault in the disposition of taxing the issue insurance money as the inherited property, as it can be considered that the heir to the summary actually paid the premium of the issue insurance

(1)Inheritance and gift tax common sense 17

image text translation

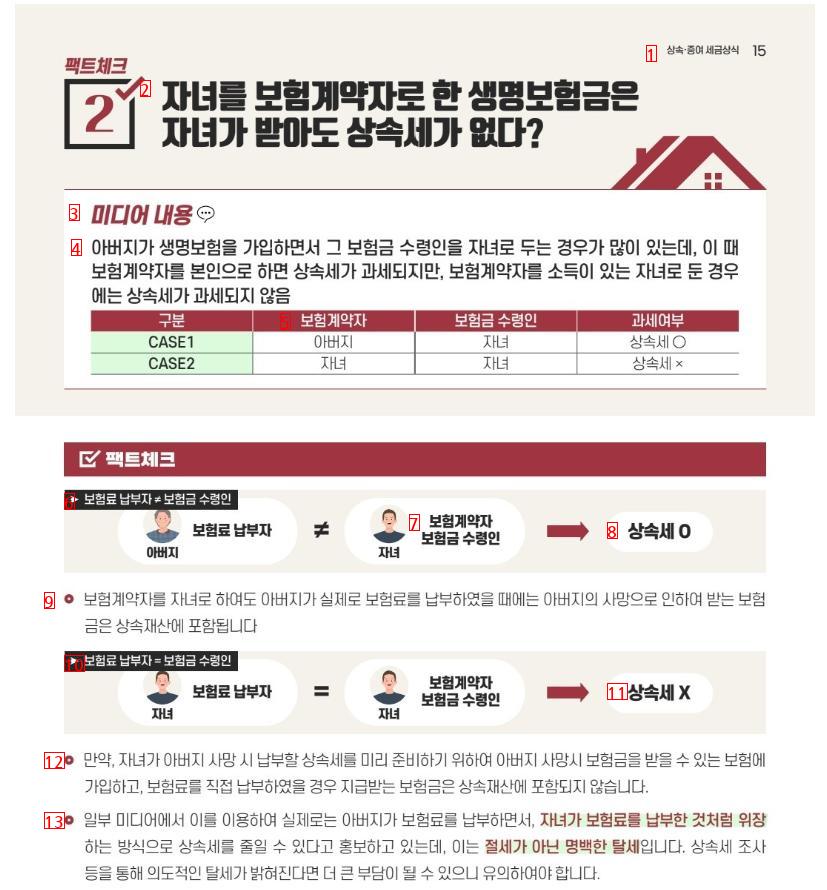

(2)If your child gets a loan and your parents repay it for you 3

(3)be tax-free giftable

(4)Media Content

(5)If a creditor or a third party removes or pays off the debt instead, the debtor is the same as the reduced debt, so gift tax is levied. Gift tax due to debt exemption can be given cash to children without gift tax by taking advantage of the fact that joint tax obligations do not apply. When the recipient cannot pay the tax

(6)the obligation of the giver to pay taxes on his behalf

(7)If a child who is unable to pay the money gets a loan from a bank with his or her parents’ property as collateral and the parents pay back the loan instead, the child has no money to pay the tax, and the gift tax due to the debt exemption does not have to pay the gift tax either

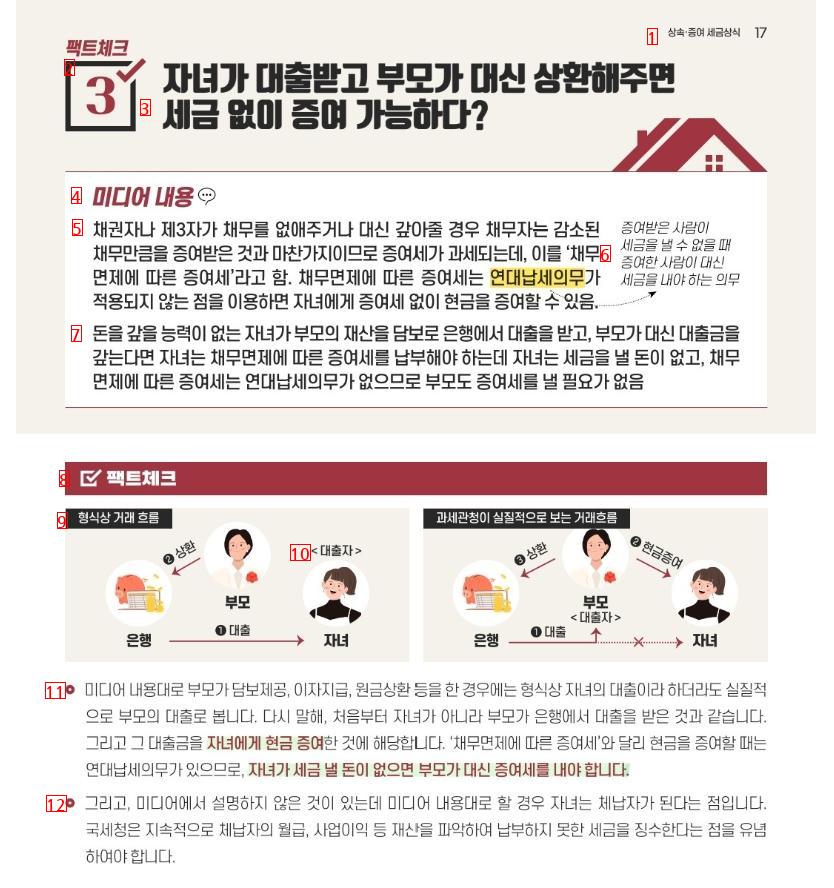

(8)The Fact Check

(9)Formal transaction flow The actual transaction flow viewed by the tax office

(10)

(11)According to the media content, if a parent repays the principal, etc. to provide collateral, interest payment, etc., even if it is a child’s loan, it is actually regarded as a parent’s loan In other words, it’s like parents, not children, took out loans from the bank from the startAnd that’s a cash gift to your child Unlike gift tax due to debt exemption, there is a joint tax obligation when giving cash, so if your child does not have the money to pay the tax, parents must pay the gift tax instead

(12)● And there’s something that the media didn’t explain, and if you follow the media content, your child will be in arrearsIt should be noted that the National Tax Service continuously identifies property such as salary business profits of delinquents and collects taxes that have not been paid

(1)Inheritance and gift tax common sense 18

image text translation

(2)Acts and subordinate statutes, interpretation cases, etc

(3)Article 4-2 of the Inheritance Tax and Gift Tax Act is obligated to pay gift tax

(4)① The recipient is obligated to pay gift tax on the gifted property according to the following categories

(5)1 The recipient includes a non-profit corporation in which the headquarters of the resident or main office is located in Korea Hereinafter, in the same case as in this paragraph, all gifted property subject to gift tax pursuant to Article 4

(6)⑤ Notwithstanding paragraph (1), in cases falling under Articles 35 through 37 or 41-4 and where the recipient falls under paragraph (6) 2, all or part of the gift tax equivalent thereto shall be exempted

(7)In any of the following cases, the donor is obligated to jointly pay the gift tax paid by the recipient. Where the address or residence of the recipient is not clear, the tax claim on the gift tax

(8)To secure in case of difficulty

(9)(2) Where it is deemed that the recipient is unable to pay the gift tax, and it is difficult to secure tax claims for the gift tax even if it is forcibly collected

(10)(iii) Where the recipient is a non-resident

(11)Gifts due to exemption from debt, etc. under Article 36 of the Inheritance Tax and Gift Tax Act

(12)① Where a creditor is exempted from debt or a third party takes over or reimbursement of debt, the date of receipt of the exemption or reimbursement shall be the date of donation, and the amount equivalent to the profit from the exemption, etc. shall be the value of the gifted property

(13)Review and Gift 2001-010520011130

(14)Since the name of the debt is a corporation, but the substance is a personal debt of a direct descendant of the CEO, the corporate ledger, etc., it is justified to give cash to a direct descendant who is not a corporation and to impose a joint tax obligation on the donor due to the inability to pay the gift tax of the recipient

(1)Inheritance and gift tax common sense 19

image text translation

(2)As a congratulatory money for the newlyweds

(3)There is no tax problem with buying a house

(4)Media Content

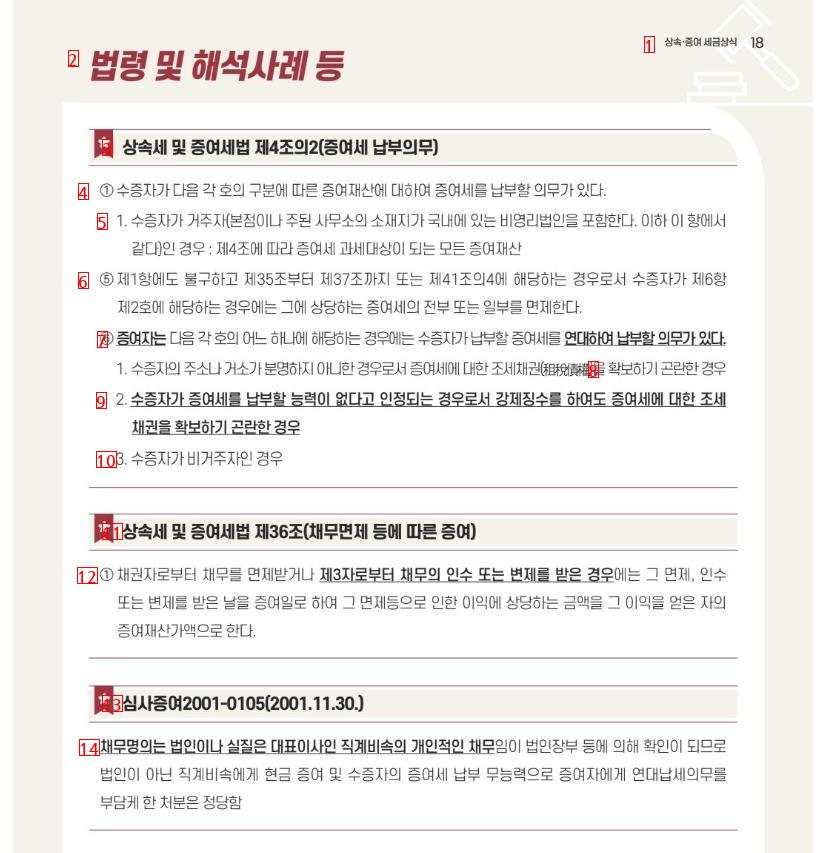

(5)There is no gift tax on wedding gifts, so there is no problem with gift tax even if assets such as newlyweds are purchased as congratulatory money

(6)The congratulatory money is free of charge, but gift tax is not levied on the congratulatory money received at the usual levelIn addition, gift taxes are not levied on the daily comatose items that parents buy from the marriage partner when they marry

(7)But unconventional levels of congratulatory money, luxury goods, houses, cars, etc. are taxable property

(8)On the other hand, you have to be careful when you buy assets with congratulatory money This is because gift tax can be levied depending on who purchased the asset with the congratulatory money attributed to

(9)According to the precedent, based on the close relationship between the married party and the bride, the part that can be considered to have been handed directly to the married party belongs to the married party, and the rest belongs to the parents who are married in full

(10)· There is nothing wrong with newlyweds acquiring assets with congratulatory money attributable to them, but if they purchase assets with congratulatory money attributable to their owners, gift taxes may be imposed as they are deemed to have received cash from their parents

(11)According to Article 53 of the Inheritance Tax and Gift Tax Act, the gift tax is deducted up to 50 million won for 10 years, so if there is no property donated before marriage, it is not taxed up to 50 million won at the time of marriage

(12)Lastly, if you plan to acquire assets with congratulatory money, it is recommended to keep a guest book so that it can be confirmed that it has been handed over directly to the marriage party according to your close relationship with the bride

(1)Inheritance and gift tax common sense 20

image text translation

(2)Acts and subordinate statutes, interpretation cases, etc

(3)The scope of non-taxable gifted property, etc. under Article 35 of the Enforcement Decree of the Inheritance Tax and Gift Tax Act

(4)④ In Article 46, Subparagraph 5 of the Act, “What is prescribed by Presidential Decree means the direct expenditure for the relevant purpose as falling under any of the following subparagraphs

(5)(iii) Souvenir congratulatory money and other similar money and goods that are normally deemed necessary

(6)(iv) Money and other goods that are normally deemed necessary for marriage

(7)For written online consultation, Unit 4-1642 20050912

(8)Concealment goods deemed necessary as prescribed in subparagraph 4 of Article 35 of the Enforcement Decree of the Inheritance Tax and Gift Tax Act shall be limited to household goods necessary for daily life and shall not include luxury luxury goods, houses, vehicles, etc

(9)Beware 20080806 20090430

(10)Unless the amount attributable to the claimant is confirmed among the wedding congratulations received from the guests at the time of marriage, the claimant’s claim that the marriage congratulations money attributable to the claimant cannot be accepted

(11)Seoul High Court 200822831 20100210

(12)Marriage gold is a social practice that has been established as a traditional breeze in our society, and aims to relieve the economic burden of parents who are married couples who are expensive at once. Therefore, it is considered that the rest of the money is attributed to the parents who are married couples, except for the part that is considered to have been handed directly to the marriage party based on the intimate relationship with the bride and groom

(1)Inheritance and gift tax common sense 21

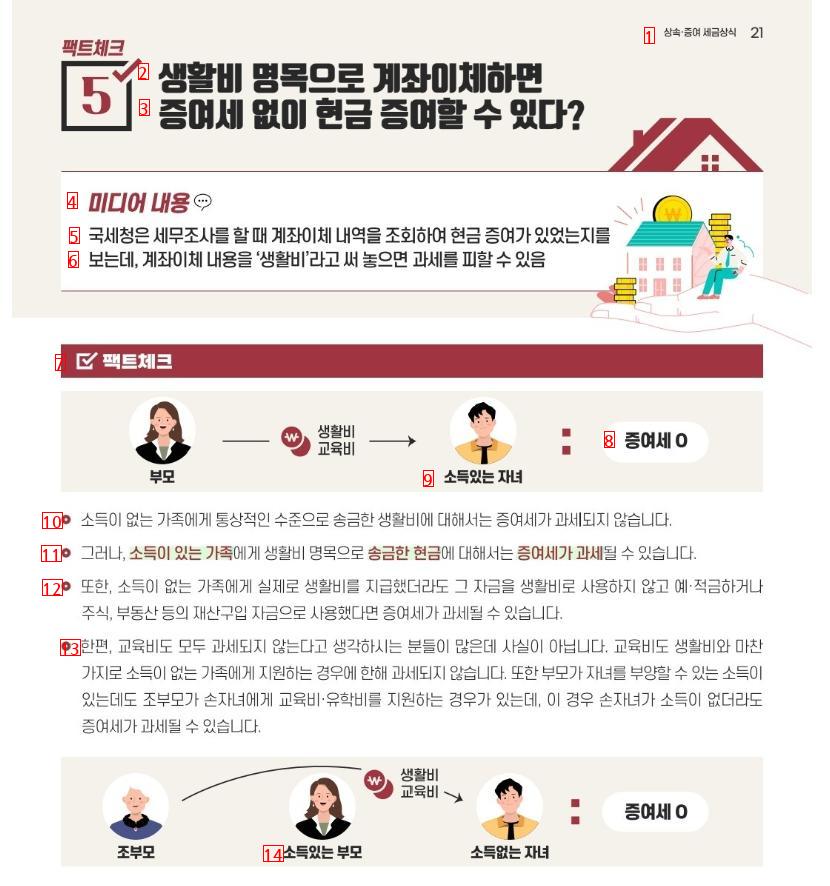

image text translation

(2)If you transfer your account in the name of living expenses

(3)to be able to give cash without a gift tax

(4)Media Content

(5)When conducting a tax audit, the National Tax Service inquires about the account transfer details to see if there was a cash gift

(6)If you write down the account transfer as living expenses, you can avoid taxation

(7)The Fact Check

(8)gift tax zero

(9)a child of income

(10)Gift tax is not levied on living expenses transferred to a family without income at a normal level

(11)h However, gift tax may be levied on cash transferred to families with income in the name of living expenses

(12)○ In addition, even if the living expenses were actually paid to the family without income, gift tax may be levied if the funds were used as funds for the purchase of property such as stock and real estate without using them as living expenses

(13)On the other hand, there are many people who think that all education expenses are not taxed, but it is not true. Education expenses are not taxed only if you apply to a family that has no income, just like living expenses In addition, even though parents have income to support their children, there are cases where grandparents support their grandchildren for education and study abroad, and in this case, gift taxes may be levied even if the grandchildren do not have income

(14)a child with no income and no income

(1)Inheritance and gift tax common sense 22

image text translation

(2)Acts and subordinate statutes, interpretation cases, etc

(3)Article 46 of the Enforcement Decree of the Inheritance Tax and Gift Tax Act: Non-taxable gifted property

(4)Gift tax shall not be imposed on amounts falling under any of the following subparagraphs

(5)5 Medical expenses for Lee Jae-gu’s family-friendly treatment, living expenses for dependents, education expenses, and other similar expenses prescribed by Presidential Decree

(6)★ Property Tax Division-4168 20081210

(7)A person who acquires property through the gift of another person is obligated to pay gift taxes pursuant to Articles 2 and 4 of the Inheritance Tax and Gift Tax Act, and if a grandfather, who is not obligated to support, bears the living or education expenses of his grandson, it does not constitute tax-free gifted property prescribed in Article 46 (5) of the same Act

(8)For written online enquiry No. 4 Unit-2163 20070712

(9)The term “living expenses or education expenses” for which gift tax is not taxed means property acquired by gift to directly cover such expenses whenever necessary. In property acquired in the name of living expenses or education expenses, if the property is deposited or deposited or used as purchase funds for stock land, housing, etc., it shall be regarded as living expenses or education expenses that are not taxed

!