Small villas and officetels are also considered homeless

The government has pulled out a non-apartment small house card to speed up housing supply The government also added measures to boost demand by excluding small houses and residential officetels from the number of houses when applying the tax system if they purchase or lease them over the next two years

httpsnnewsnavercomarticle6480000022443ntype=RANKING

image text translation

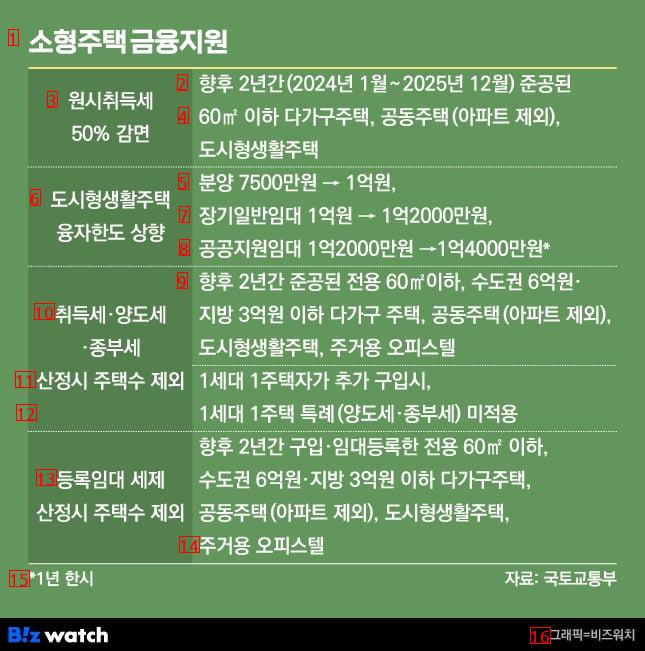

(1)Financial support for small housing

(2)Over the next two years, it will be completed from January 2024 to December 2025

(3)original acquisition tax reduction of 50

(4)Urban-type residential housing excluding multi-family housing apartments under 60㎡

(5)75 million won for sale → 100 million won

(6)Increasing the Loan Limit for Urban Living Housing

(7)100 million won for long-term general lease → 120 million won

(8)120 million won for public support lease → 140 million won

(9)600 million won in the Seoul metropolitan area under 60㎡ completed over the next two years

(10)Apart from multi-family housing apartments under 300 million won in acquisition tax and transfer tax, residential officetels for urban-type residential housing

(11)When an additional one-family homeowner purchases, excluding the number of houses at the time of calculation

(12)Except for multi-family housing with 600 million won in the Seoul metropolitan area and 300 million won in the local area, excluding multi-family housing apartments, which were purchased and rented for the next two years without the transfer tax and comprehensive real estate tax

(13)registered rental tax system

(14)a residential officetel

(15)One-year provisional data, Ministry of Land, Infrastructure and Transport

(16)Graphics=Bizwatch

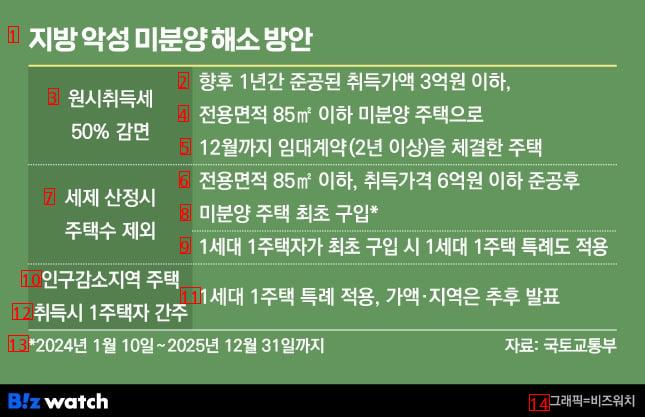

(1)A Study on the Resolution of Local Malicious Unsoldings

image text translation

(2)Acquisition value of 300 million won or less completed over the next year

(3)original acquisition tax reduction of 50

(4)It is an unsold house with a dedicated area of 85㎡ or less

(5)a house with a lease of more than two years until December

(6)After completion of the acquisition price of less than KRW 600 million with an exclusive area of 85㎡ or less

(7)Excluding the number of houses when calculating the tax system

(8)the first purchase of an unsold house

(9)When a one-family homeowner purchases for the first time, the special exemption for one-family home is also applied

(10)a housing in a depopulated area

(11)The value and area of special application for one household and one house will be announced later

(12)Consideration of a single homeowner when acquired

(13)Data from January 10, 2024 to December 31, 2025 Ministry of Land, Infrastructure and Transport

(14)Graphics=Bizwatch

To save the construction company