image text translation

(1)I didn’t think so, but this kind of thing happened

(2)the fear of D spreading throughout the country

(3)Input 20230809 PM 543 Modified 20230810 AM 239

(4)Reporter Lee Jihoon

(5)a family of one street

(6)Production and consumer prices negative

(7)China fell into a deflationary swamp

(8)7월 CPI -03 PPI -44

(9)The government’s stimulus package is nullified

(1)China’s consumer price growth turned negative in July for the first time in two years and five months, analysts say China has virtually fallen into deflation amid sluggish global demand and domestic demand

image text translation

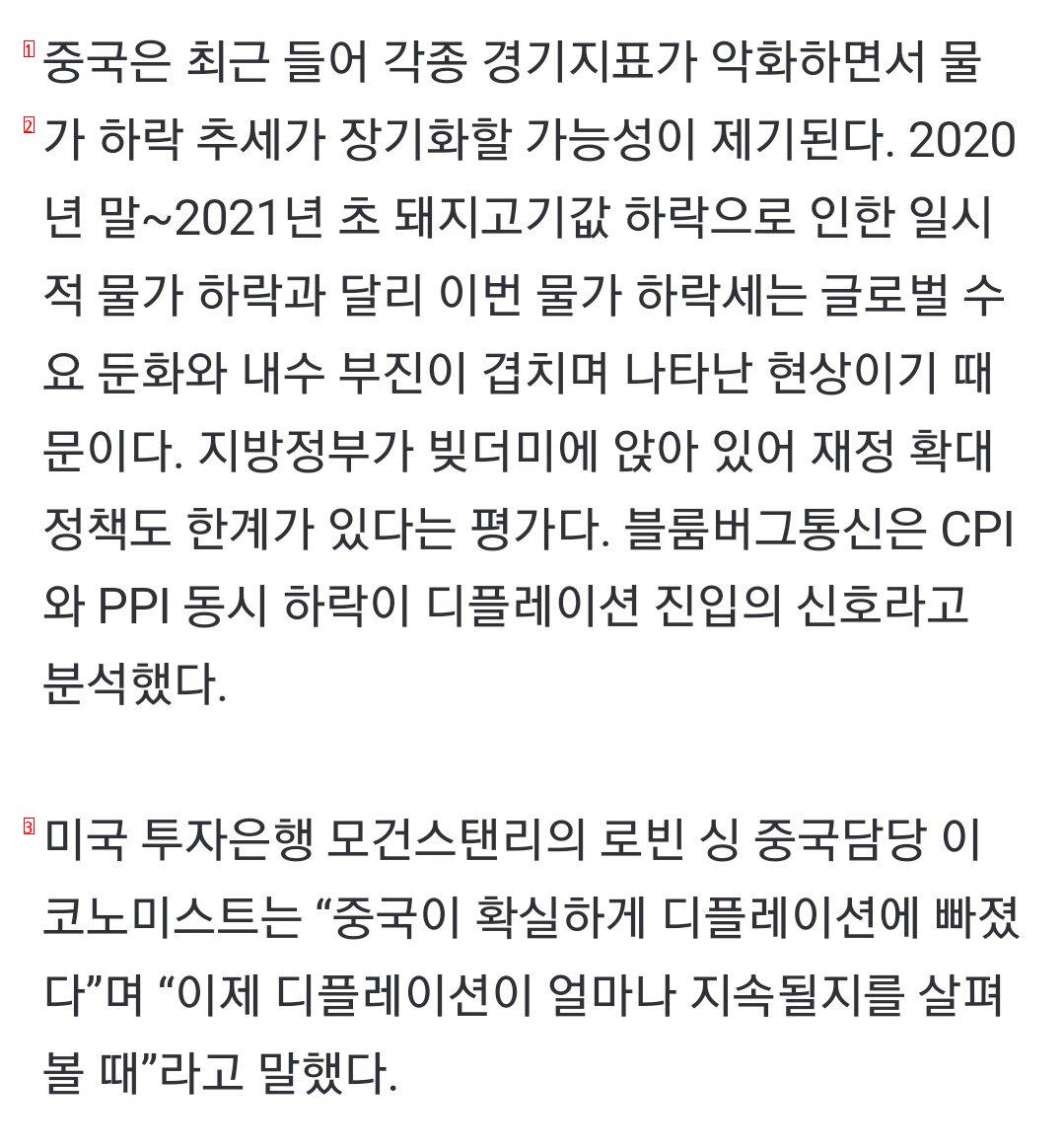

(1)China’s National Bureau of Statistics reports consumer price index CPI for July

image text translation

(2)It was announced on the 9th that it fell 03 compared to the same period last year The CPI has been negative for the first time since February-02 2021 during the COVID-19 pandemic The CPI’s leading indicator, producer price index PPI, fell 44 year-on-year for the 10th consecutive month, falling more than Reuters estimates -41, the first time since November 2020 that CPI and PPI have been negative at the same time

(3)CHINA PRICE INDEX VARIABLE UNIT

(4)consumer inflation rate

(5)producer inflation rate

(6)January and March 2023

(7)※Compared to the same month last year, China National Bureau of Statistics

(1)China’s water as various economic indicators have worsened in recent years

image text translation

(2)There is a possibility that the downward trend of prices will be prolonged. Unlike temporary price declines caused by falling pork prices from late 2020 to early 2021, this fall in prices is a phenomenon caused by slowing global demand and sluggish domestic demand As local governments are in debt, fiscal expansion policies are also limited, Bloomberg analyzed that the simultaneous fall in CPI and PPI is a sign of entering deflation

(3)”China is definitely in deflation,” said Robin Singh, an economist at U.S. investment bank Morgan Stanley. “It’s time to look at how long deflation will last.”

(1)Earlier this year, China’s economy played the role of the global economy’s growth engine

image text translation

(2)Unlike the U.S., which is implementing intensive austerity measures, China is because the People’s Bank of China continues its monetary easing policy and the “COVID-19” policy ended at the end of last year Experts generally expected that China’s economy would show strong growth for the first time in a long time as demand that had been suppressed during the zero-COVID-19 period erupted

(3)However, this expectation was missed. China’s economic growth rate in the second quarter of this year was 63 compared to the same period last year, which was higher than 45 in the first quarter, but it was a shock that fell far short of the market forecast of 71 As the growth rate fell short of expectations, the July consumer price growth rate announced on the 9th turned negative for the first time in two years and five months, there are concerns that the Chinese economy may be bogged down by Japanese-style deflation

(4)It is pointed out that consumption shrinks due to the reverse asset effect caused by falling real estate prices, which could lead to a vicious circle in which corporate investment decreases and jobs decrease

(1)Chinese firms’ consumption not picking up after ‘reopening’

image text translation

(2)Competitively cutting product prices is also adding to the downward pressure on prices

(3)The problem is that the policy response card is not suitable. Usually, if the economy slows down, the People’s Bank of China has boosted the economy by lowering its key interest rate or reserve ratio, but recently, it is burdensome to boldly implement monetary easing policies due to the burden of weak yuan

The crisis from China came all over the world and made it hard for everyone

China was pretending to be strong

Eventually, deflation came to a head

There’s no way to break through this lol

These days, China no longer pretends to be strong whether it’s Jeonrang or Jrang

Busy begging around lol

In the end, the 1.3 billion won that I was proud of

It’s 1.3 billion to feed

Deflated China will be harder than any other country

AI IMAGE