image text translation

(1)Of course, I don’t want to save money

(2)I’m sure he’ll pay all the taxes

(3)Basic progressive deductions

(4)Take them all out and make them easy to understand

(5)Let’s just calculate it semantically

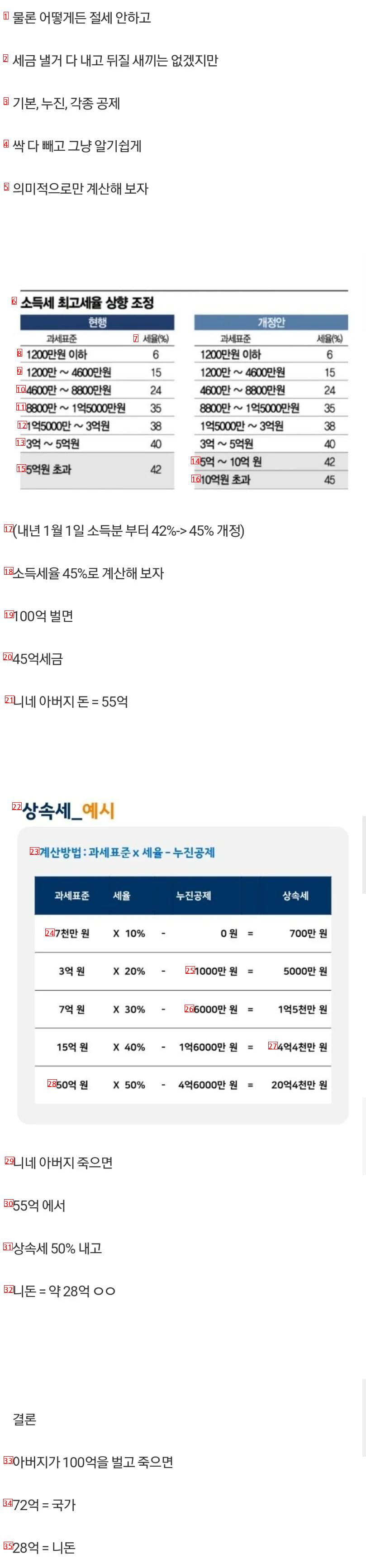

(6)raising the maximum income tax rate

(7)a tax rate

(8)12 million won or less

(9)12 million to 46 million won

(10)46 million won to 88 million won

(11)88 million to 150 million won. 88 million to 150 million won

(12)150 million to 300 million won

(13)300 million won to 500 million won

(14)500 million won to 1 billion won

(15)More than 500 million won

(16)More than 1 billion won

(17)Revised income from January 1st next year to 42->45

(18)Let’s calculate the income tax rate at 45

(19)If you make 10 billion won

(20)4.5 billion tax

(21)Your father’s money = 5.5 billion

(22)Inheritance tax_example

(23)Calculation Method Tax Base x Tax Rate – Progressive Deduction

(24)70 million won. 7 million won

(25)10 million won. 50 million won

(26)60 million won = 150 million won

(27)440 million won, 1.5 billion won, 160 million won

(28)5 billion won. 460 million won

(29)If your father dies

(30)from 5.5 billion won

(31)I’ll pay 50 in inheritance tax

(32)Nidon = approximately 2.8 billion ㅇ

(33)If my father dies after making 10 billion won

(34)7.2 billion = Country

(35)2.8 billion = Nidon

!