a husband who is worried about his wife’s way of speaking on payday

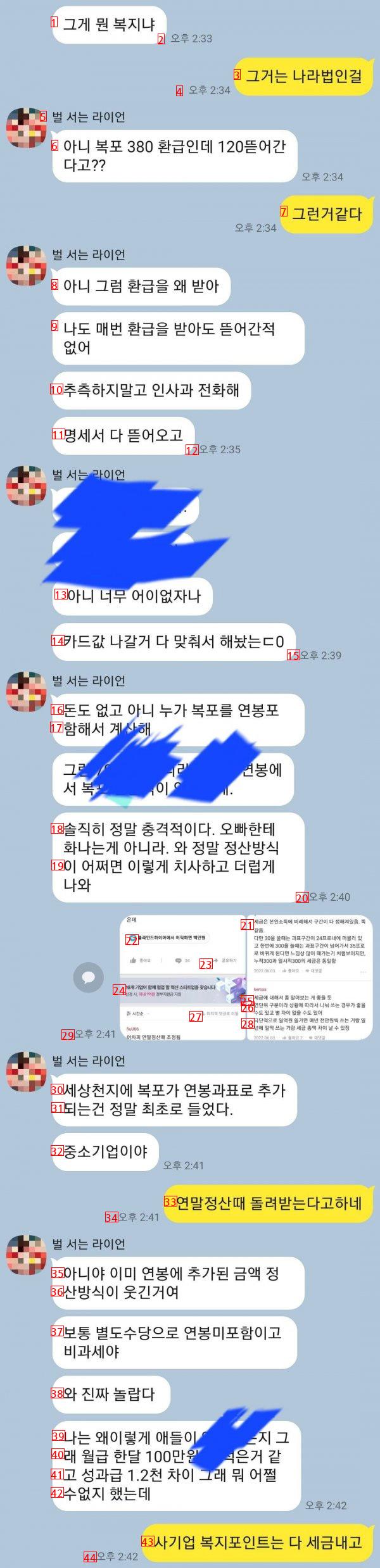

image text translation

(1)Forum > Concern Forum

(2)Popular payday wife tone 66

(3)an anonymous man

(4)2023-04-24 1533 Inquiry 4382

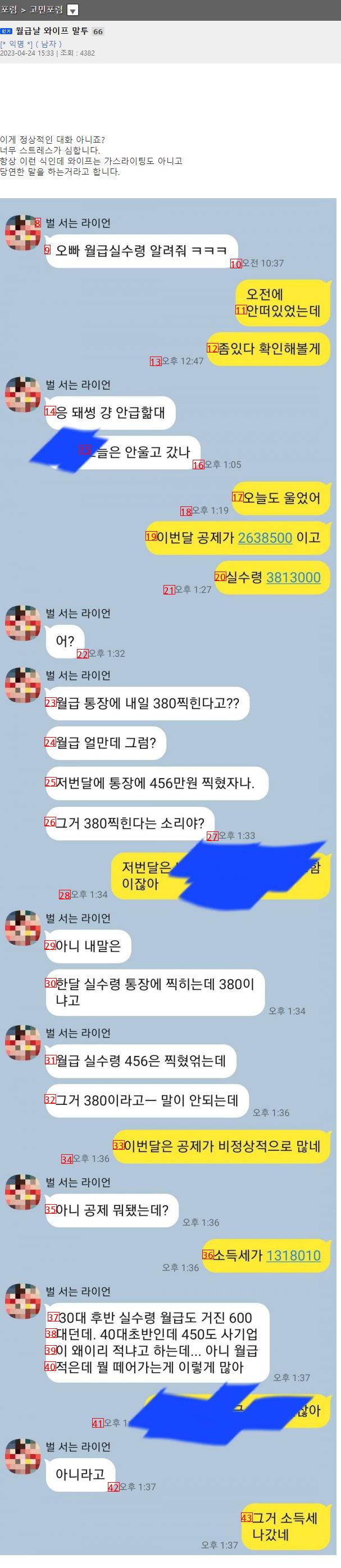

(5)This is not a normal conversation

(6)I’m so stressed out

(7)It’s always like this, but my wife says it’s not gaslighting

(8)The punishment is Ryan

(9)Tell me the actual receipt of your salary

(10)1037am

(11)It wasn’t on the screen

(12)I’ll check it out later

(13)1247pm

(14)Yes, it’s okay. It’s not urgent

(15)Didn’t they cry

(16)105 p

(17)I cried again today

(18)119 p.m

(19)This month’s deduction is 2638500

(20)Actual acceptance 3813000

(21)127 in the afternoon

(22)132pm

(23)My salary will go up to 380 tomorrow

(24)How much is your salary then

(25)Last month, 4.56 million won was recorded in my bank account

(26)That means it’s going to be recorded as 380

(27)133 p

(28)134pm

(29)No, I mean

(30)380 is recorded in my bank account for a month’s mistake

(31)I got 456 on the payroll

(32)That’s 380. – That doesn’t make sense

(33)There’s an unusual amount of deductions this month

(34)136pm

(35)No, there’s a deduction

(36)Income tax is 1318010

(37)In his late 30s, his monthly salary was also 600

(38)I heard it’s big. I’m in my early 40s, but it’s 450 degrees

(39)They’re asking why my salary is so small

(40)It’s small, but why are you taking it off so much

(41)11pm

(42)137pm

(43)Income tax

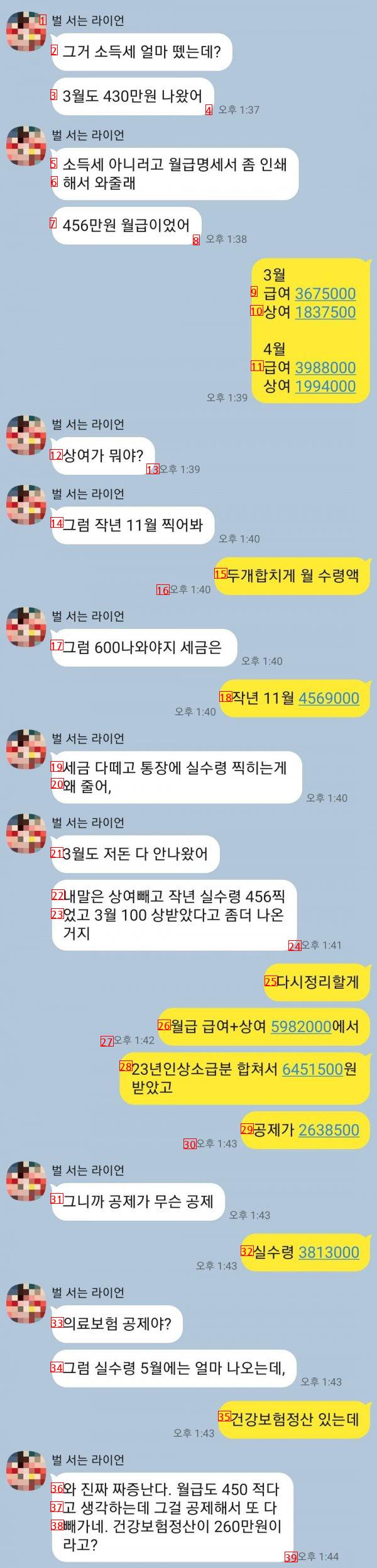

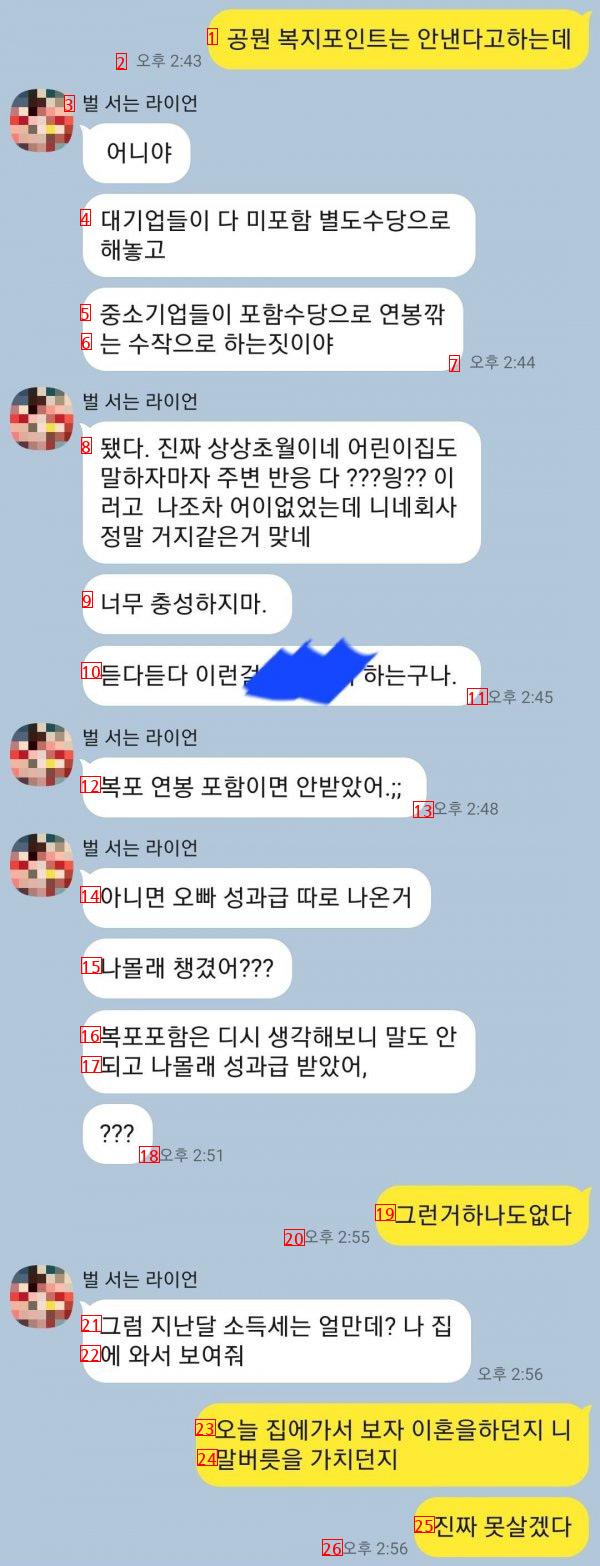

(1)The punishment is Ryan

image text translation

(2)How much income tax did you get

(3)It was 4.3 million won in March

(4)137pm

(5)Not income tax. Print your salary statement

(6)Will you do that

(7)It was 4.56 million won

(8)138pm

(9)Salary 3675000

(10)Bier 1837500

(11)Salary 3988000 bonus 1994000

(12)What’s a bier

(13)139pm

(14)Then film it in November last year

(15)the amount received per month in two

(16)140 p

(17)Then it should be 600

(18)Last November, 4569,000

(19)It’s not like I’m going to get a mistake on my bank account after paying all my taxes

(20)Why is it decreasing

(21)That money didn’t come out in March either

(22)I mean, except for the bier, I got 456 last year

(23)And in March, we got 100 awards

(24)141pm

(25)I’ll clean it up again

(26)From salary, salary, bonus, 5982000

(27)142 p

(28)I got 6451500 won for the 23 year raise

(29)Deductible price: 2638500

(30)143pm

(31)What kind of deduction

(32)Actual acceptance 3813000

(33)It’s a health insurance deduction

(34)Then how much will it cost in May

(35)There’s a health insurance settlement

(36)Wow, I’m so annoyed. My salary is 450 less

(37)That’s what I think, but I’ll deduct that and

(38)You’re taking it away. The health insurance settlement is 2.6 million won

(39)144 p

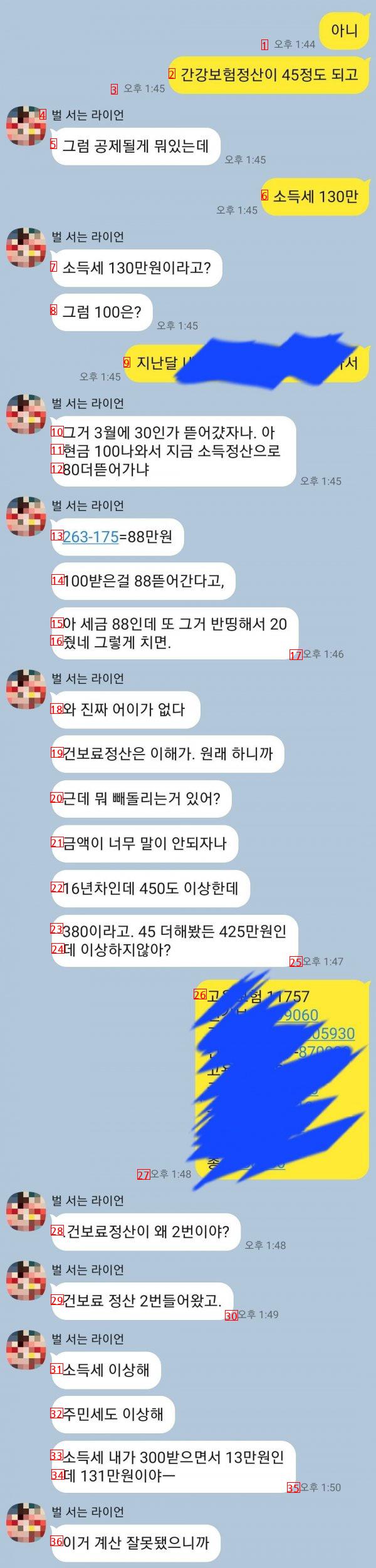

(1)144 p

image text translation

(2)The amount of liver insurance settled is about 45

(3)145pm

(4)The punishment is Ryan

(5)Then what’s there to deduct

(6)income tax of 1.3 million

(7)Income tax is 1.3 million won

(8)Then 100

(9)Last month I

(10)They took it off at 30 in March

(11)I got 100 in cash, so I’m going to settle my income

(12)Why did you get 80 more

(13)263 to 175.88 million won

(14)I’m going to take out 88 from 100 points

(15)Ah, the tax is 88, but it’s half and 20

(16)I gave it to you

(17)146pm

(18)Wow, I’m speechless

(19)I understand how to pay for health insurance

(20)But there’s something to steal

(21)The price doesn’t make sense

(22)It’s been 16 years. 450 degrees is weird

(23)It’s 380 and 45 won. It’s 4.25 million won

(24)It’s not weird

(25)147 p

(26)Tough 1757

(27)148pm

(28)Why is the health insurance bill number two

(29)I got paid for my health insurance twice

(30)149pm

(31)Income tax is weird

(32)The resident tax is weird, too

(33)Income tax is 130,000 won for 300 won

(34)It’s 1.31 million won

(35)150 p

(36)Since this calculation is wrong

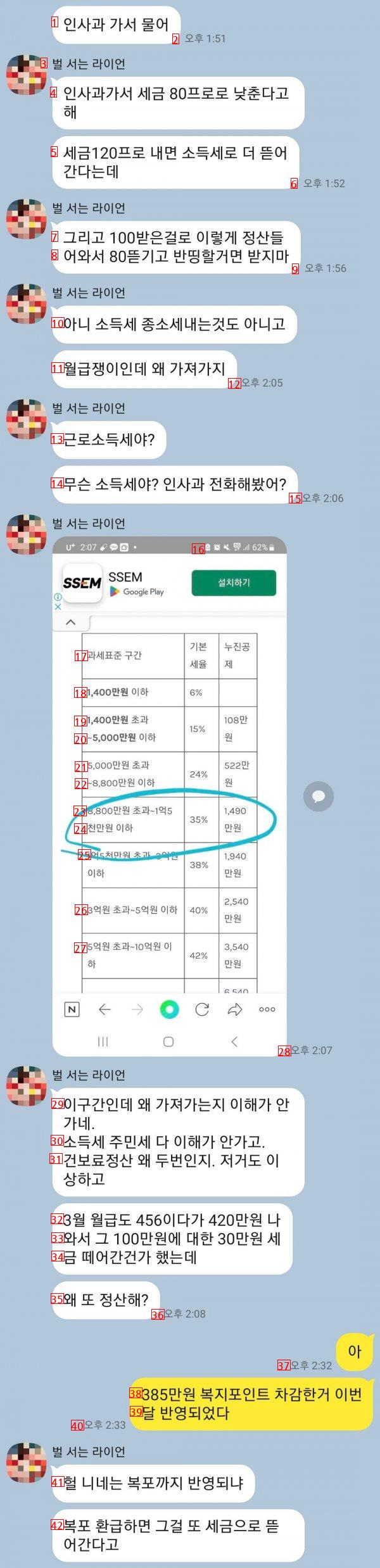

(1)Go to the HR department and ask

image text translation

(2)151pm

(3)The punishment is Ryan

(4)The HR department will lower the tax by 80 percent

(5)If you pay 120% of the tax, you’ll get more income tax

(6)152pm

(7)And with 100 points, I’ll pay for it

(8)If you’re gonna come and rip 80 and half, don’t take it

(9)156pm

(10)No, it’s not like I’m paying income tax

(11)Why would you take it when you’re a salaried worker

(12)205pm

(13)It’s earned income tax

(14)What income tax? I called HR

(15)206pm

(16)Sashimi 62

(17)Tax base section

(18)14 million won or less

(19)Over 14 million won

(20)~50 million won or less

(21)Over 50 million won

(22)~88 million won or less

(23)More than 88 million won~150 million won

(24)10 million won or less

(25)More than 10,000 won. 200 million won

(26)More than 300 million won to less than 500 million won 40

(27)More than 500 million won to less than 1 billion won

(28)207pm

(29)I don’t understand why you take it when it’s this section

(30)I don’t understand income tax, resident tax

(31)Why is it twice? That’s weird, too

(32)My salary in March was 456 and then 4.2 million won

(33)He came and paid 300,000 won for that 1 million won

(34)I thought he took the gold

(35)Why are you paying

(36)208pm

(37)232pm

(38)3.85 million won, minus welfare points

(39)moon-reflected

(40)233pm

(41)Wow, you guys are even reflecting the blowfish

(42)If I get a refund, I’ll open it with tax

(1)What kind of welfare is that

image text translation

(2)233pm

(3)That’s the law of the country

(4)234pm

(5)The punishment is Ryan

(6)No, it’s a refund of 380, but it’s 120

(7)I think so

(8)Then why would I get a refund

(9)I got a refund every time, but I took it away

(10)Don’t guess. Call HR

(11)I’ll take out all the bills

(12)235pm

(13)No, it’s so ridiculousI

(14)I’ve set up everything to pay for my credit card

(15)239pm

(16)I don’t have money. Who pays for the blowfish

(17)I’ll count it together

(18)Honestly, it’s really shocking. I’m not mad at you. Wow, the way you pay

(19)How can you come out so cheap and dirty

(20)240 p

(21)Taxes are all defined in proportion to one’s income

(22)If you change jobs at Blind Liar, the target section stays within 24% when you use 30, and if you use 300 at a time, the target section goes over and changes to 35%, it seems to be a lot of time, but the cumulative 300 and temporary 300 taxes are the same

(23)Share

(24)16 Companies Find Collaborative Innovation Startups Togetherat the time of application

(25)Maybe you should find out more about taxes

(26)It’s divided by the year, so it might be good to share it depending on the situation or there might be no difference

(27)4 Move Last Light Road

(28)If you’re going to spend 100 million won, there could be a difference in the total amount of tax between spending 10 million won every year and working a year

(29)241 PM – Adjusted at year-end tax adjustment anyway

(30)Bokpo is added to the world as an annual salary table

(31)It’s the first time I’ve ever heard it work

(32)It’s a small business

(33)He’s getting it back at the year-end tax adjustment

(34)241pm

(35)No, the amount that’s already been added to the annual salary

(36)That’s the funny way to live

(37)Usually, the salary is not included as a separate allowance

(38)Wow, that’s amazing

(39)Why are they so

(40)I think Rae ate a million won a month.m. a month

(41)There’s 12,000 difference in performance-based pay. So what

(42)I thought I couldn’t do it

(43)You pay taxes on all the welfare points of private companies

(44)242pm

(1)They don’t pay for park welfare points

image text translation

(2)243pm

(3)The punishment is Ryan

(4)All the big companies set it up as a separate allowance

(5)Small and medium-sized businesses cut salaries with inclusion allowances

(6)That’s a trick

(7)244pm

(8)It’s really beyond my imagination. As soon as I said it, everyone around me said yes. Even I was dumbfounded, but your company is really a beggar

(9)Don’t be too loyal

(10)You’re doing this while listening

(11)245pm

(12)I didn’t get paid if my salary was included in the mourning clothes;;

(13)248pm

(14)Or your performance-based pay

(15)I secretly packed it

(16)Come to think of it, I can’t believe it

(17)I got a bonus secretly

(18)251pm

(19)There’s nothing like that

(20)255pm

(21)Then how much was your income tax last month

(22)Come and show me

(23)I’ll see you at home today. You’re getting divorced

(24)I’ll use my words

(25)I can’t stand it

(26)256pm