image text translation

(1)Topic > Year-end tax adjustment

(2)Even if you do anything, you have no choice but to pay 1300 won.

(3)Yes.

(4)New company w

(5)I liked Zola because her salary went up.

(6)Why isn’t the actual amount of income so big compared to the increase?

(7)I spent 60 million won on Shinka and Chekka, including my parents and all my dependents, but I don’t want to be a separate expense handling company because the company’s expenses are likely to be 3,000 won.

(8)But I can’t reduce the amount of tax.

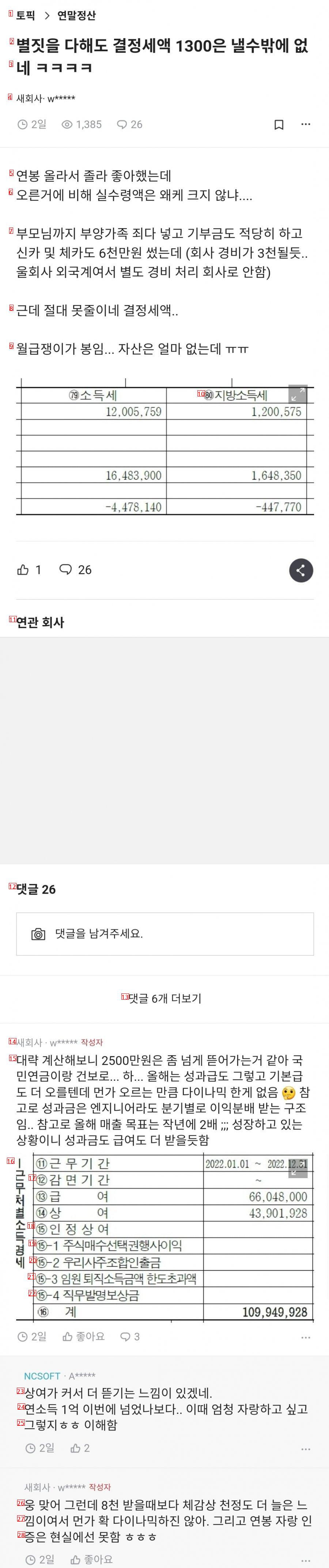

(9)The salaryman doesn’t have a lot of assets in his salary.

(10)80 Local Income Tax

(11)affiliated company

(12)Comments 26.

(13)6 more comments.

(14)New Company w Author

(15)Roughly calculated, the national pension and health insurance seem to be taking more than 25 million won, so the performance salary will rise this year, but there is nothing dynamic as it goes up. FYI, even engineers receive quarterly profit distribution, so this year’s sales target is doubling last year, so it seems to receive more performance and salary.

(16)- Income statement by place of work 근 Working period

(17)② Reduction period

(18)⑤ recognized bonus

(19)1–1 Profit from exercising stock options

(20)15-2 Company owner’s association withdrawal

(21)⑩-3 Amount exceeding the limit of retirement income of executives

(22)⑤-4 Job Invention Compensation

(23)The bonus is big, so it feels like it’s being ripped off more.

(24)I guess I earned more than 100 million won a year. I want to brag about this.

(25)That’s right. I understand.

(26)Yes, but I feel that the ceiling has increased compared to when we received 8,000 won.

(27)It’s not very dynamic because it’s a hunch, and I’m proud of my salary.

(28)He can’t do it in real life.

!