image text translation

(1)○ Tax hike for beer and makgeolli

(2)clarification of the description of the purpose of

(3)Kim Hyun-kyung input 2023 112 1418

(4)▼ A is…

(5)Kim Hyun-kyung, a reporter for Korea Economic TV.

(6)Low 32

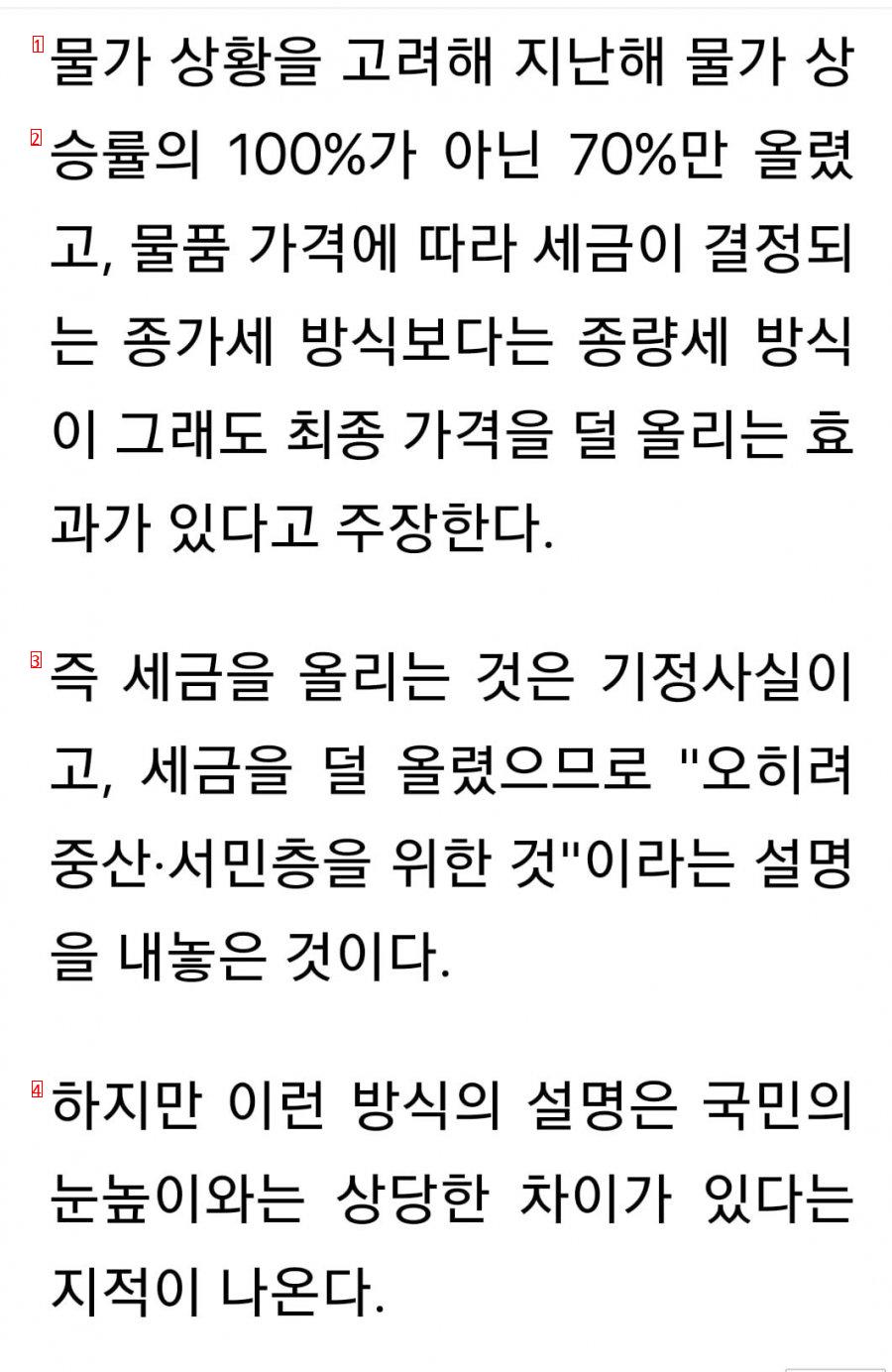

(1)last year’s inflation considering the price situation

image text translation

(2)They argue that the volume-based tax method still has the effect of raising the final price less than the closing tax method, which only raised 700,000 instead of 100 of the winning rate, and the tax is determined by the price of the goods.

(3)In other words, he explained that raising taxes is a fait accompli and that it is for the middle and common people because it has raised taxes less.

(4)However, it is pointed out that the explanation in this way is quite different from the level of the public’s eyes.

(1)Last year, 51 was a murderous commodity price.

image text translation

(2)If the government wanted to consider the middle class and the working class who suffered from the winning rate, it would be better not to raise taxes, which is a price variable that the government can decide, rather than raising taxes for the middle class and the working class.

(3)Many point out that liquor companies raise prices right after the government’s liquor tax hike, but they usually raise prices much more than the tax hike, citing the reason for the tax hike.

!