(0)DEBT

The 37-year-old couple, who got married in March last year, received a credit loan of 300 million won to set up a newlywed house

I spent 150 million won to purchase the right to move into a redevelopment apartment in Bupyeong-gu, Incheon, and with the rest of the money, I found a lease house to live in

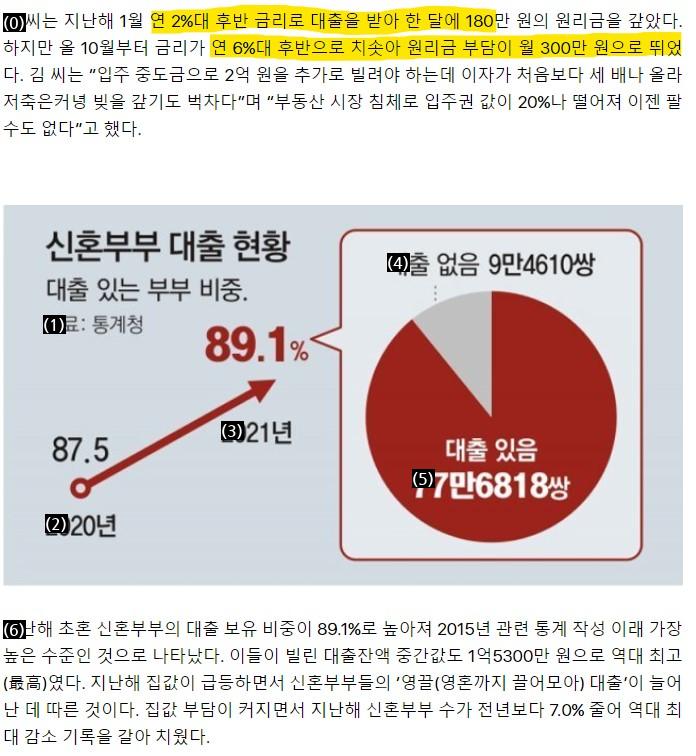

(0)Kim paid back 1.8 million won in principal and interest in January last year at the late two-year interest rate. However, the interest rate soared to late six-year-old this October and the principal burden jumped to 3 million won a month. Kim said, “I have to borrow an additional 200 million won in the middle of moving in, but I can’t pay my debts

(1)Kim paid back 1.8 million won in principal and interest in January last year at interest rates in the late 2nd half of the year. However, interest has soared to 3 million won a month since October this year. Kim said, “I have to borrow 200 million won more as a middle payment, but I can’t pay back my debts.

Household data

(2)Kim paid back 1.8 million won in principal and interest in January last year at the late two-year interest rate. However, since October this year, interest has soared to 3 million won a month. Kim said, “Interest has tripled from the beginning, and it is hard to pay back debts.

Households are now down 20 years

Household data

(3)Kim paid back 1.8 million won in principal and interest in January last year at the late two-year interest rate. However, since October this year, interest has soared to 3 million won a month. Kim said, “Interest has tripled from the beginning, and it is hard to pay back debts.

Households are now 20 years down.

Household data

2089

(4)Kim paid back 1.8 million won in principal and interest in January last year at interest rates in the late 2nd half of the year. However, since October this year, interest has soared to 3 million won a month. Kim said, “Interest has tripled from the beginning, and it is hard to pay off debts.

There are no 20 years of loans.

Households

2089

(5)Kim paid back 1.8 million won in principal and interest in January last year at the late two-year interest rate. However, since October this year, the principal and interest burden has soared to 3 million won a month. Kim said, “Interest has tripled from the beginning, and it is hard to pay back debts. There are no more loans.

Couple loans

2089,

Couple loans

2089

(6)Kim paid back 1.8 million won in principal and interest in January last year at the late two-year interest rate. However, since October this year, the principal and interest burden has soared to 3 million won a month. Kim said, “Interest has tripled from the beginning, and it is hard to pay back debts. There are no more loans.

Couple loans

2089,

Couple loans

2089 It turned out to be the highest level since statistics were compiled The median loan balance they borrowed was 153 million won, the highest ever This is due to the sharp rise in housing prices last year, attracting the souls of newlyweds and increasing loans As the burden of housing prices increased, the number of newlyweds decreased by 70 last year from the previous year, breaking the record of the biggest drop ever

(0)10 hours ago

If you speculated, you should take responsibility.

Are you out of your mind to buy 200 million won worth of 800 million won?

(1)10 hours ago

If you speculated, you should take responsibility.

Are you out of your mind if you bought 200 million won for 800 million won?

Writing a reply

(2)10 hours ago

If you speculated, you should take responsibility for it.

Are you out of your mind?

Writing a reply

11 hours ago

Paying the price of desire and greed

Writing a reply

!