image text translation

Maeil Business Newspaper

@Gudeuk

PiCK

*MSG Morgans Lanley

Global public responsible for ‘smelling money’ in monthly rent demand

Beans flock together

Ipler2024.1201 666 PM. Modified20241202 1226 AM

Introduction to articles

‘Reporter Park Ja-young. Reporter Dang Sun-min ~

all)

ruler

Article 130 operation Hines enters the domestic market

Beyond office hotel Singapore investment

Joo Ki-yong rental full-fledged Gongrak Shisa

“Expected to improve rental market confidence”

“I’m worried that the price is much higher and you’re acting like a bastard.”

Jinsesagi Pobiya

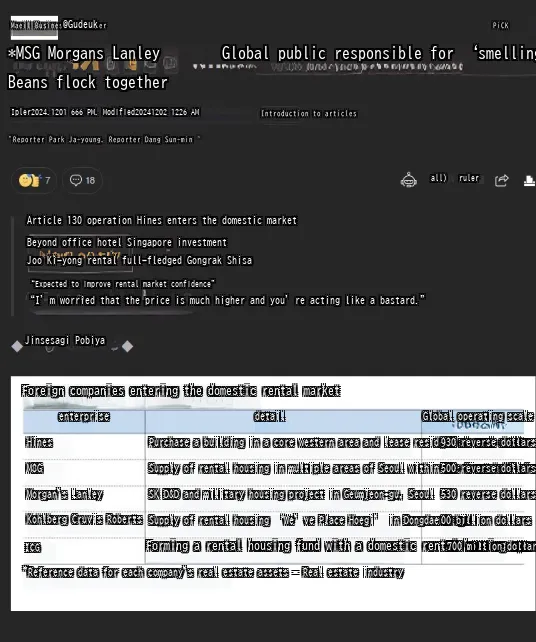

Foreign companies entering the domestic rental market

enterprise

detail

Global operating scale

Hines

Purchase a building in a core western area and lease residential real estate

930 reverse dollars

M8G

Supply of rental housing in multiple areas of Seoul within the first half of next year

500 reverse dollars

Morgan’s Lanley

SK D&D and military housing project in Geumjeon-gu, Seoul

530 reverse dollars

Kohlberg Cruvis Roberts

Supply of rental housing ‘We’ve Place Hoegi’ in Dongdaemun-gu

00 billion dollars

ICG

Forming a rental housing fund with a domestic rental housing operator

700 million dollars

“Reference data for each company’s real estate assets – Real estate industry

The major players in the global real estate-Geumwoom market, including American Heinst, one of the world’s top three real estate companies, are domestic.

image text translation

They are entering the large-scale housing market one after another. Foreign capital has been using commercial properties such as offices and shopping malls in Korea.

This is a completely different movement from the previous focus on real estate investments. Much better deals in the rental market

Changes are expected in the domestic rental market as more and more foreign ‘catfish’ appear –

Meanwhile, foreign capital has hesitated to enter Korea’s unique tax system, which is difficult to find in other countries.

It’s surprising, but the recent increase in one- to two-person households has been noticeable, and demand has grown significantly due to instability in the jeonse market.

The analysis is that the Korean market, which is rapidly changing, is being singled out as a new opportunity. Hines has been an office

Although we only focused on building investments, this is the first time we have entered the rental housing business in Korea.

M&G Reil Estate, a subsidiary of Purhoesul Life Insurance in the UK, also owns two commercial facilities, including office towers.

It is right to focus on the character, but the situation has changed. Recently, the residential rental market has decided to move forward. Da So-min-hyung M&G Real S

Date Korea CEO said, “In Korea, the won tax and anti-tax market will be weakened as the proportion of power tax will be changed from 2022.”

“It is growing rapidly,” he said. “It is a rental business that has a landlord that professionally manages its assets and operates stably.”

“As India is expected to increase, the entry of institutional investors is expected to accelerate,” Malgyalda said.

Outside of the world’s top three investment banks, Morgans Lanley and U.S. private equity fund Golberg Kravis Rovers (KKR) are British.

Global major players such as ICG, a self-management company, have recently

Morgan Stem has declared its entry into the rental housing market.

Lee is pursuing a 195-room rental housing project in cooperation with SK D&D in Geumcheon-gu, Seoul, and in Seongbuk-gu.

Seodo is also preparing a 60-room residential facility KK, a global private equity fund with operating assets of KRW 870 trillion.

R is accelerating its entry into the domestic market by joining hands with Webribang, a Yongkong-based shared housing company in Yeongdeungpo-gu.

While Han Hotel All Premium is being renovated as a residential space, Dongdaemun District has already opened a rental house called ‘Weave Trace Society’.

There is no show.

ICG Noon, a large British investment management company, and Eumjeureobkkeoni, a domestic real estate specialist, were valued at 300 billion won last year.

They were arrested in commercial real estate in Gangnam, Gasin, and Donggyeong areas, as well as the Gyeonggi Sumun area.

The business of purchasing and converting it into a main facility is being carried out. Foreign capitals are doing it with the help of jeonse scams.

It is expected that changes in the country’s demographic structure will lead to changes in the renter market. According to statistics from last year,

The number of single-person households in Korea is 7.83 million, which is 35.59 percent of full-body households – 4, which is a non-mobile family type.

This is twice the size of organizations with more than 3.7 million people. If the scope is expanded to organizations with 1-2 people, the proportion will be 6,496.

It is predicted that Illumi will rise to 7096 new in 2030.

What is especially noteworthy is that the housing type of these small households is concentrated in the Ilse area. KS Geumwoom Grop

According to the recently published ‘2024 Korea One-person Household Report’, 45.196 people are living in Wulse.

This is an increase of 8.99 points compared to 2022.

[Reporter Park Jae-young / Reporter So Soon-min]

‘Korea

https://n.news.naver.com/mnews/article/009/0005405998

Foreign financial companies that smell money are now jumping into Korea’s real estate market.

Real estate speculation began as people bought buildings and rented them out.

image text translation

Yes, buy it~~ It’s okay if you don’t even look at the real estate~~~~~

I can see that the jeonse will disappear and the monthly rent will soar haha.