image text translation

(1)In the case of Japan

(2)What you’re looking at is the same as before

(3)Japan’s Money Base and

(4)And the real estate in Japan

(5)It’s a chart. On the chart。

(6)Just the green and red histograms at the back

(7)It’s a chart that went up in 2012 and 2013. What is this? 2020

(8)of Japanese payrolls

(9)It’s an increase or decrease in real wages

As a result of the central bank’s continued spraying of money over the past 15 years, the yellow line of real estate prices in the white line is rising without stopping

image text translation

(1)In the case of Japan

(2)We’re living on a salary

(3)2013 Real wages for earned income earners are 2020

(4)The number of green noodles has increased every month

(5)And if it’s red

(6)Rather, it’s decreased It’s like this

(7)If you look at 2012, it’s clear It’s clear at a glance

(8)There’s a lot more red, right

(9)The result of the 2012 helicopter splashing of money

(10)This is it Unlimited quantitative easing

(11)the people of Japan during this period of implementation

(12)In particular, the real wages of earned income earners are

(13)2011 Slowly

(14)He was standing in line. He became poor 12022H

In the meantime, the bar chart shows real wages for Japanese earned income earners

There are significantly more red than green Japanese workers

I’ve been poor for the past 15 years

image text translation

(1)In the case of Japan

(2)The central bank and the government have joined hands

(3)20 The price of releasing money like crazy is 2020

(4)We’ve got income earners like us

(5)I mean, I carried it all the way back in 2013 2020

Spreading money has left earned income earners increasingly poor

Why did this happen

image text translation

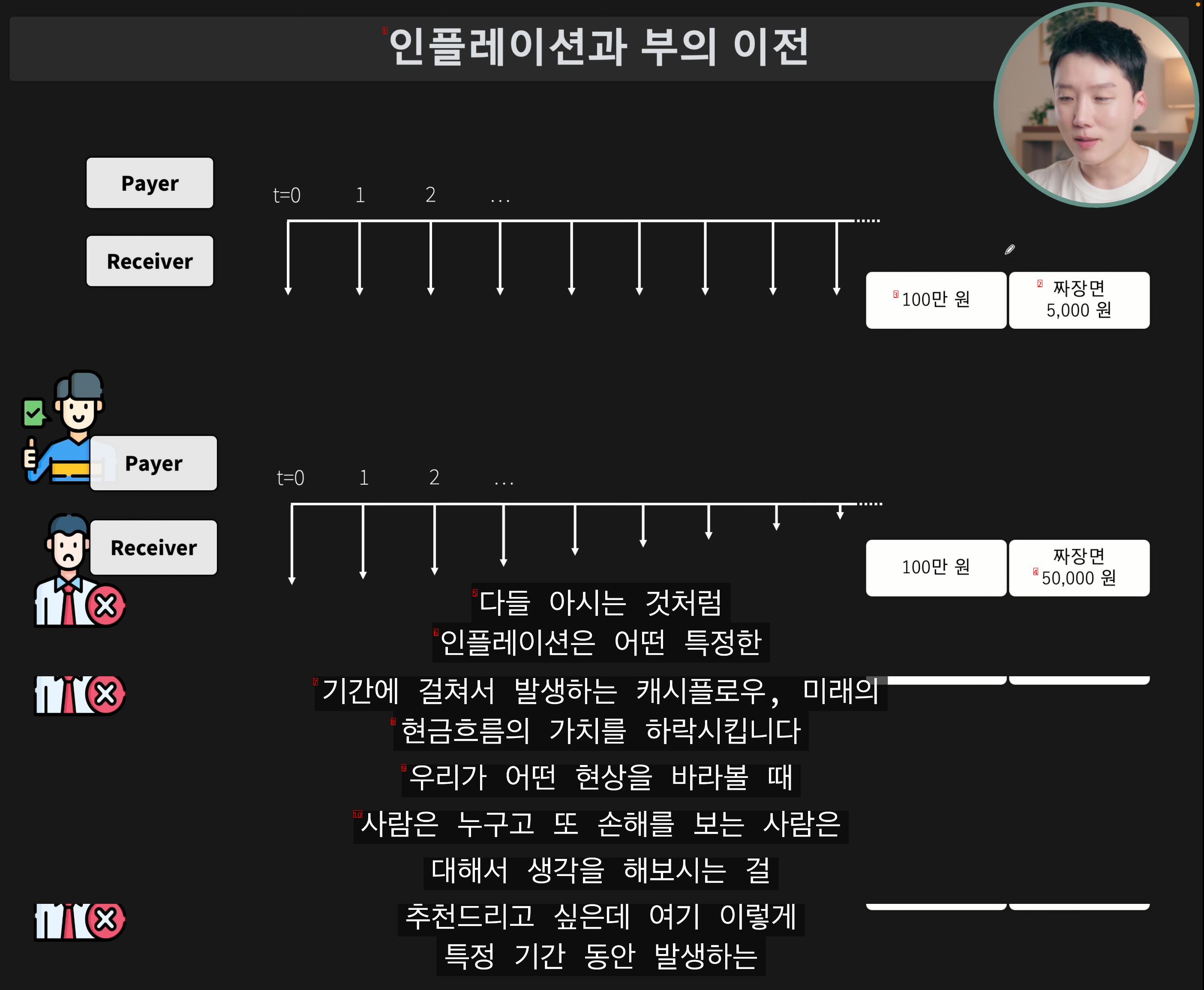

(1)Inflation and wealth transfer

(2)Jajangmyeon is 5,000 won

(3)100 million won

(4)50,000 won

(5)As you all know

(6)Inflation is a certain kind of thing

(7)Cashflows occurring over a period of time

(8)It lowers the value of the cash flow

(9)When we look at a phenomenon

(10)I want to recommend you think about who you are and who you lose, but for a certain period of time

(1)Inflation and wealth transfer

image text translation

(2)100 million won

(3)five thousand won

(4)50,000 won

(5)Let’s say there’s a cash flow

(6)We’ll call the payer of this cash flow a Payer and the receiver a Receiver. What happens when inflation happens? As time goes by

(7)The value of future cashflows converted to present value will gradually go down like this

(8)It’s so obvious

In an inflationary situation, the value of a fixed cash flow is

The present value concept gradually declines over time

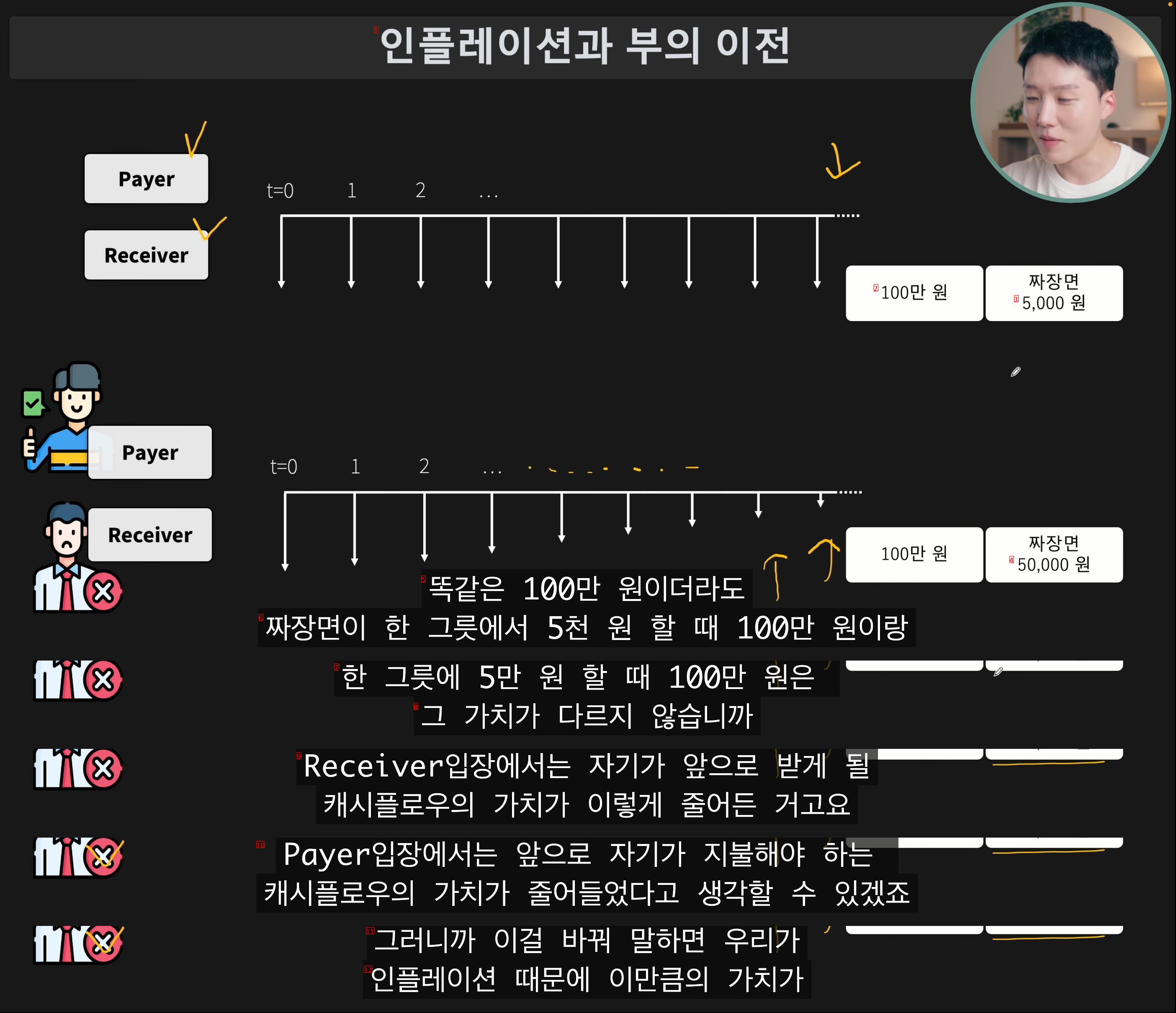

image text translation

(1)Inflation and wealth transfer

(2)100 million won

(3)five thousand won

(4)50,000 won

(5)Even if it’s the same 1 million won

(6)For one bowl of jajangmyeon, it costs 1 million won

(7)If it’s 50,000 won per bowl, 1 million won is

(8)The value is different, isn’t it

(9)From the receiver’s point of view, the value of the cash flow you’re going to receive has been reduced

(10)From Payer’s point of view, you might think that the value of the cash flow you’re going to have to pay has diminished

(11)If we change this

(12)Because of inflation, this is how much value it’s worth

Even if you get the same 1 million won, when the jajangmyeon is 5,000 won

The value of 1 million won is different when it comes to 1 million won and 50,000 won

The sharp fall in the value of pension lotteries in the age of great inflation is the same reason

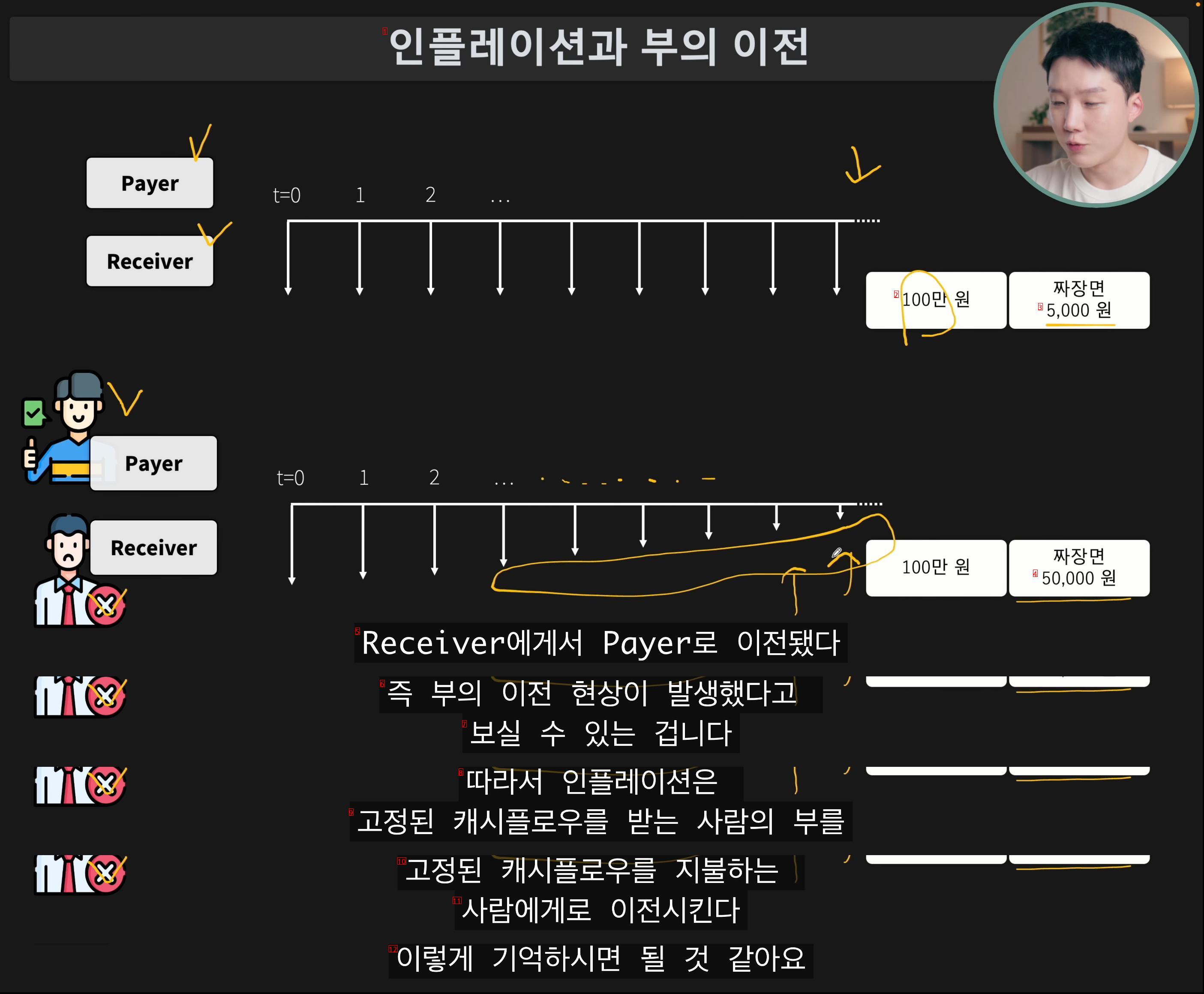

image text translation

(1)Inflation and wealth transfer

(2)100 million won

(3)five thousand won

(4)50,000 won

(5)It was transferred from Receiver to Payer

(6)In other words, wealth transfer has occurred

(7)You will be able to see it

(8)So, inflation is

(9)The wealth of the recipient of a fixed cache flow

(10)paying a fixed cash flow

(11)transfer to a person

(12)You can remember it like this

Inflation is the wealth of the recipient of a fixed cash flow

transfer to the payer

image text translation

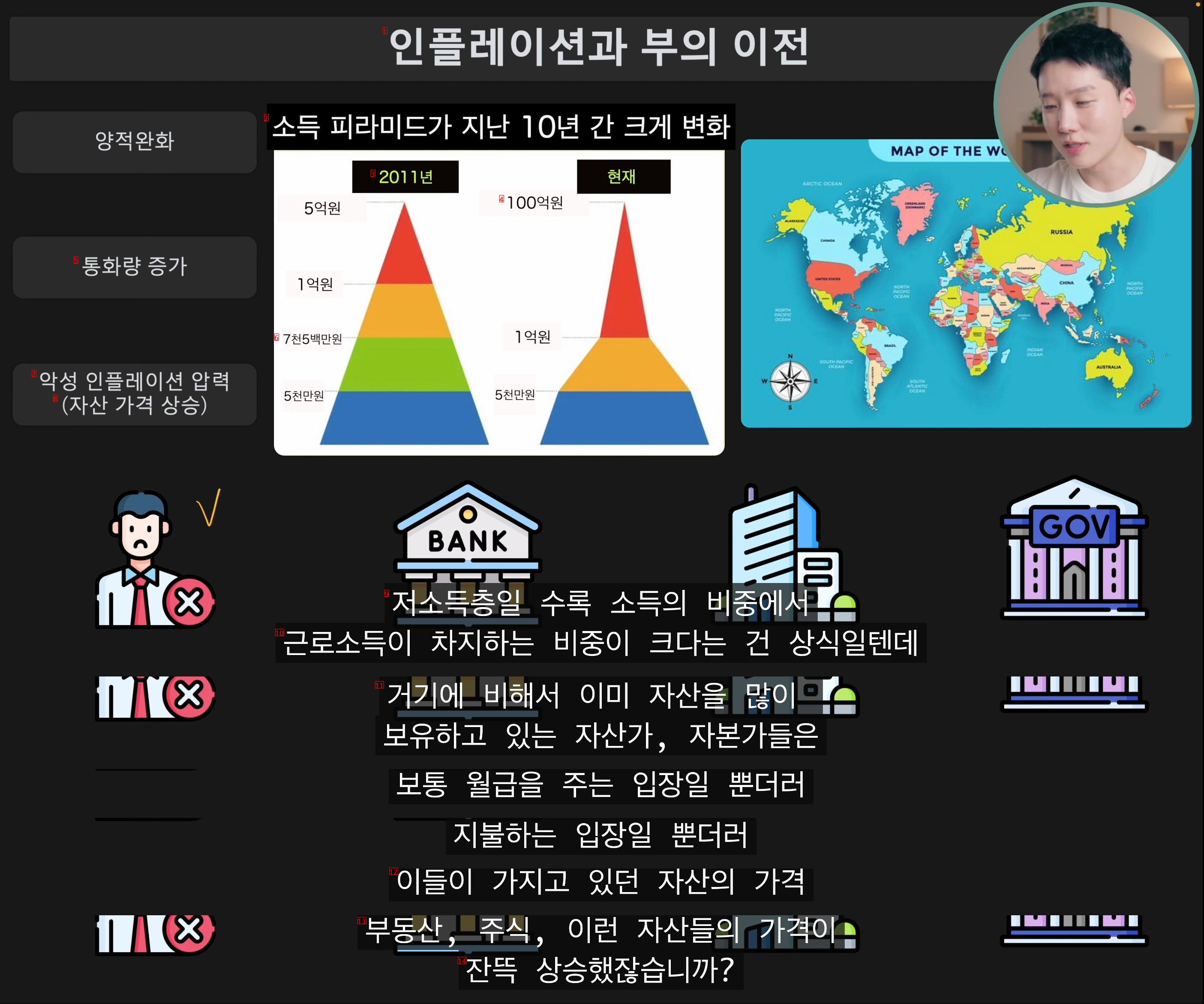

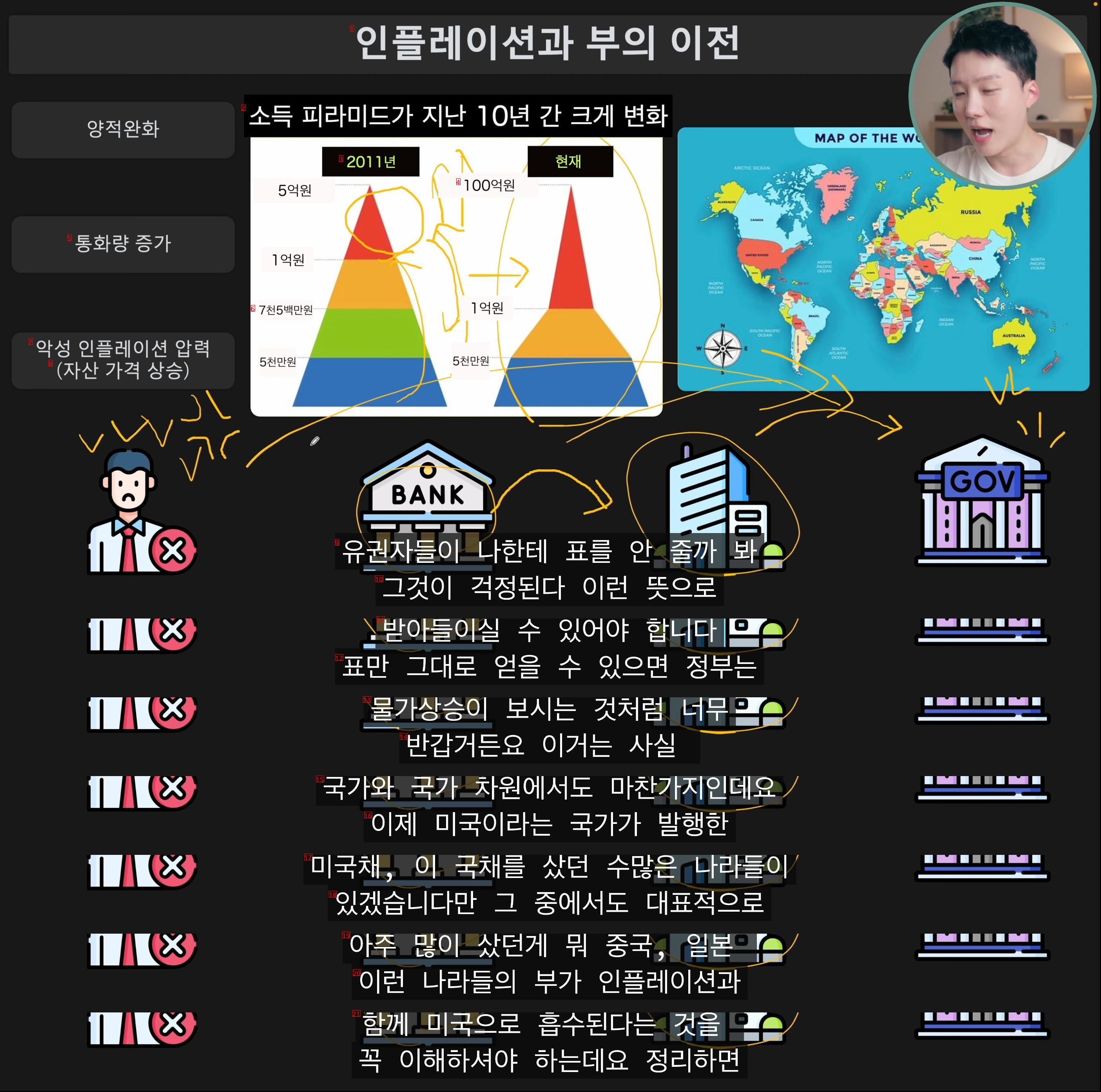

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)So we’re going to use the same logic of each economic entity

(10)Let’s introduce it to a relationship

(11)First, let’s look at the individual’s perspective, divided by the income bracket

(12)Who is the representative economic entity that receives a fixed cash flow

(13)They’re working income earners like us

Representative economic entities receiving fixed cash flows

They’re working income earners like us

image text translation

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)The lower the income bracket, the higher the income

(10)It’s common sense that earned income accounts for a large portion

(11)In comparison, asset capitalists who already have a lot of assets are usually in a position of paying and paying

(12)the price of their assets

(13)Real estate stocks. The prices of these assets

(14)It’s gone up a lot

The lower the income bracket, the higher the portion of earned income

In addition, most of the assets that increase in value due to inflation, such as real estate and stocks, are held by a small number of capitalists and wealthy people

image text translation

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)After all, through these processes

(10)Through inflation and quantitative easing

(11)with the wealth and capital of low-income families

(12)It’s going to be transferred to the high-income bracket

(13)That’s why income polarization occurs

(14)It means it’s right here

(15)The same logic is am

(16)It also applies between banks and businesses

In the end, inflation is the wealth of the low-income class to the high-income class

producing the effect of transferring

image text translation

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)whether there are many or few companies

(10)with some borrowed money from the bank

(11)I run a company with debtthe addition of the bank to which interest is received

(12)It’s transferred to a company that pays interest

(13)What about the government Of all economic players, the most welcoming and welcoming inflation is

(14)It’s the government government-issued

(15)the wealth of investors who bought government bonds from numerous government bonds

(16)To the government through inflation

(17)It’s because the government will be relocated. In other words, the government

(18)through generating inflation

(19)It means that you can significantly reduce your debt or interest payment burden

Of all economic players, it is the government that welcomes inflation the most

a huge amount of debt borne by the government

the payment of interest on a debt that has risen to an astronomical scale

Transferring the burden to other economic players with inflation

image text translation

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)As an example of Japan

(10)Didn’t you check? Most of the government bonds issued by the Japanese government are held by Koreans

(11)In the end, for the past 20 years, the Japanese people

(12)The reason why the government is getting poorer is because

(13)Take away the people’s money, take away the wealth

(14)To inflate the assets of high earners

(15)Or to reduce the government’s debt burden

(16)It’s because I was using it

(17)From the perspective of politicians

(18)I’m worried about inflation

(19)If you listen to it, that’s

(20)- due to rising prices

(21)The situation of the people who will suffer

(22)I’m worried about my life That’s not what I meant

(23)He’s mad about inflation

The reason why the Japanese people have become increasingly poor over the past 20 years is because

That’s because of the money that the government has siphoned off with unlimited quantitative easing and the resulting inflation

In Korea, there is an opinion that 100 million won should be randomly distributed per childbirth family as a countermeasure against low birth rate, but a disorderly liquidity expansion policy could further devastate the lives of earned income earners

There could be a world where a bottle of powdered milk costs hundreds of thousands of won

image text translation

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)I’m afraid the voters won’t vote for me

(10)I’m worried about that That’s what I mean

(11)You have to be able to accept it

(12)If we can get the votes as they are, the government will

(13)As you can see, inflation is so

(14)It’s nice to meet you

(15)It’s the same at the national and national level

(16)Now, it’s been published by a country called the United States

(17)So many countries that bought these U.S. government bonds

(18)There will be, but one of them is

(19)I bought a lot of things. China and Japan

(20)The wealth of these countries, inflation

(21)You have to understand that you’re going to be absorbed into the U.S. together

The same logic applies across countries

of countries that receive fixed cash flows that buy U.S. government bonds

Wealth Absorbs Into U.S. With Inflation

image text translation

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)The Government, as I said, is quantitative easing

(10)The biggest beneficiary of inflation

(11)In the case of companies, too

(12)I’m actually taking out the debt that I borrowed from the bank

(13)a large enterprise that can be reduced

(14)When it comes to selling products

(15)It has some pricing power

(16)We benefit from this quantitative easing

(17)In August 2021, the average price of raw materials rose during the Shin Ramen COVID-19, the representative ramen

(18)I’ve raised prices, but the companies that have increased prices for products in over a year

(19)Even if the raw material price drops again, the price doesn’t fall

(20)have a tendency to raise You’ve seen a lot of cases where price performance goes up When the price of the ingredients goes up

We’ve lowered the price of the raw materials, but we won’t lower the price of the goods! Wink

image text translation

(1)Inflation and wealth transfer

(2)The Income Pyramid Has Changed Significantly Over The Last 10 Years

(3)Year 2011

(4)10 billion won

(5)an increase in money supply

(6)75 million won

(7)Malicious inflationary pressure

(8)an increase in asset prices

(9)▣ What about the bank

(10)The bank is a government or a corporation

(11)I’m in the position of lending money, and on the contrary, I’m in the position of receiving interest

(12)You get direct damage from quantitative easing and inflation, but in the end, the damage that banks do to individual depositors

(13)You can transfer the deposit rate

(14)By lowering the interest rate and raising the loan rate!

(15)After all, who’s the most damaged in this process

(16)It’s an individual. That’s also earned income

(17)earning a living on one’s salary

(18)Individuals suffer the most damage

The central bank’s reckless monetary easing policy due to the government’s fiscal expansion

For the past 20 years and this moment, the Japanese people are constantly becoming poor

What will the future of Korea be like

Source Even Chance YouTube channel