11th Street is Korea’s traditional e-commerce powerhouse

image text translation

(1)11th Street Korea’s representative open market shopping mall – started at SK Planet in 2008

(2)Major e-commerce companies’ sales in 2022

(3)Coupang is 26.3 trillion won

(4)a hundred million won

At that time, we were curiously invested 500 billion won to become Amazon in Korea in 2018

image text translation

(1)Attracts 500 Billion Investment on 11th Street in 2018

(2)- Dreaming of Korea’s Amazon in 2018 to attract 500 billion won in investment

(3)- National Pension Service Saemaul Geumgo HQ Korea, private equity fund management company, etc

(4)Investment of approximately 500 Billion Won in 1818 Equity

(5)11th Street at 27 trillion won

(6)The national pension fund is 350 billion HQ funds, 100 billion Saemaul Geumgo is 50 billion

Coupang babies don’t even seem to have a knack for it, but we’re too cheap for our skills

image text translation

(1)In 2015, Coupang received a rating of 5 trillion won

(2)- Isn’t 25 trillion won worth of 11th Street in 2018 cheap

(3)Expectations that it could be comparable to Coupang at the time

(4)- Amazon in Korea

You can go public by September 30, 2023

If you fail, save your investment at Sk Square, where you own 80 shares

The shares we invested in again, you guys buy it

It’s the same as a charter

I’ll put in 500 billion won. Give it back in two years

If you don’t give me a deposit, I’ll eat your house

image text translation

(1)500 billion won investment terms

(2)- TO FINISH IPO BY SEPTEMBER 30, 2023

(3)- If the initial public offering fails by then, investors will forcefully sell their stake in SK

(4)Possible provisions Drag Allong Insert Drag Allong

(5)- Instead, SK holds call option to buy back its stake

(6)- Conversely, if you don’t buy it back, you’ll even sell your stake in SK

(7)- The annual interest rate is 35 and lent for five years

The result is a mess lol

image text translation

(1)11th Street Operating Profit Trend

(2)a hundred million won

(3)2018! 2019! 2020! 2021! 2022

(4)More and more losses

(5)Coupang Naver’s two-way battle

(6)- Small and Medium Open Market Dark Ages

I think we’re on 11th Street. Let’s sell it

Q10 run by the first-generation e-commerce powerhouse Koo Young-bae negotiated the sale first and then stopped the negotiations

image text translation

(1)If it doesn’t go public, we have to sell it

(2)- Selling Negotiations With Singapore Firm Q10 Set Up By Gmarket Founder

(3)- Rumor that 1 trillion won was mentioned

(4)- If it’s 1 trillion won, I’ll give 500 billion won back to investors, and then I’ll take this out

(5)- There is nothing left over

(6)- With no more than 10 years of sales activity left

(7)→ In the end, acquisition negotiations broke down

Investor, it looks like you’re in trouble. We can’t even go public, so give us back our investment

image text translation

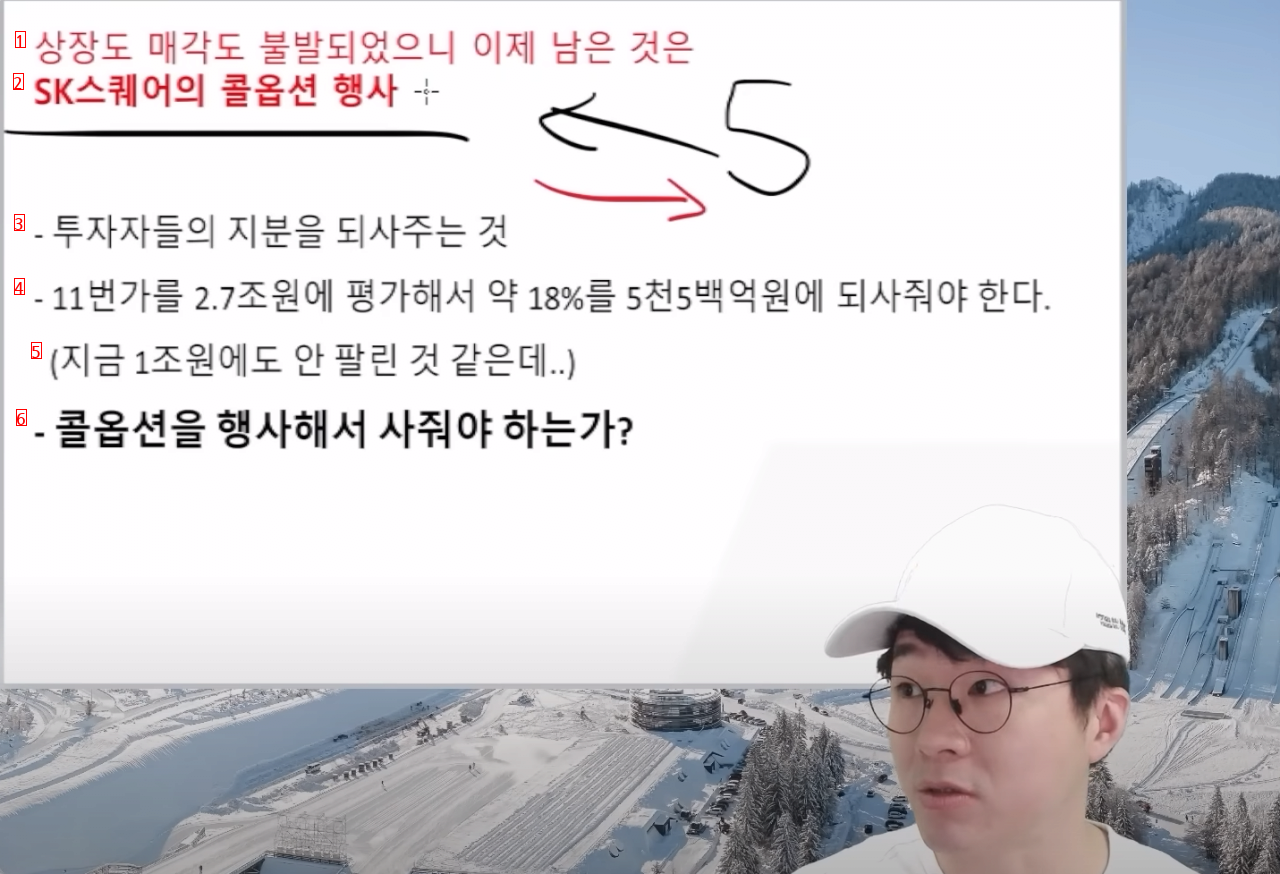

(1)Neither the listing nor the sale has been successful, so what’s left is

(2)SK Square’s Call Options Exercise

(3)- buying back shares of investors

(4)- 11th Street should be valued at 27 trillion won and about 18 should be bought back at 550 billion won

(5)I don’t think it’s even sold for 1 trillion won

(6)- Should I buy it by exercising the call option

The call and lag clause has been practically a market practice

It’s like returning the money on a deposit basis

image text translation

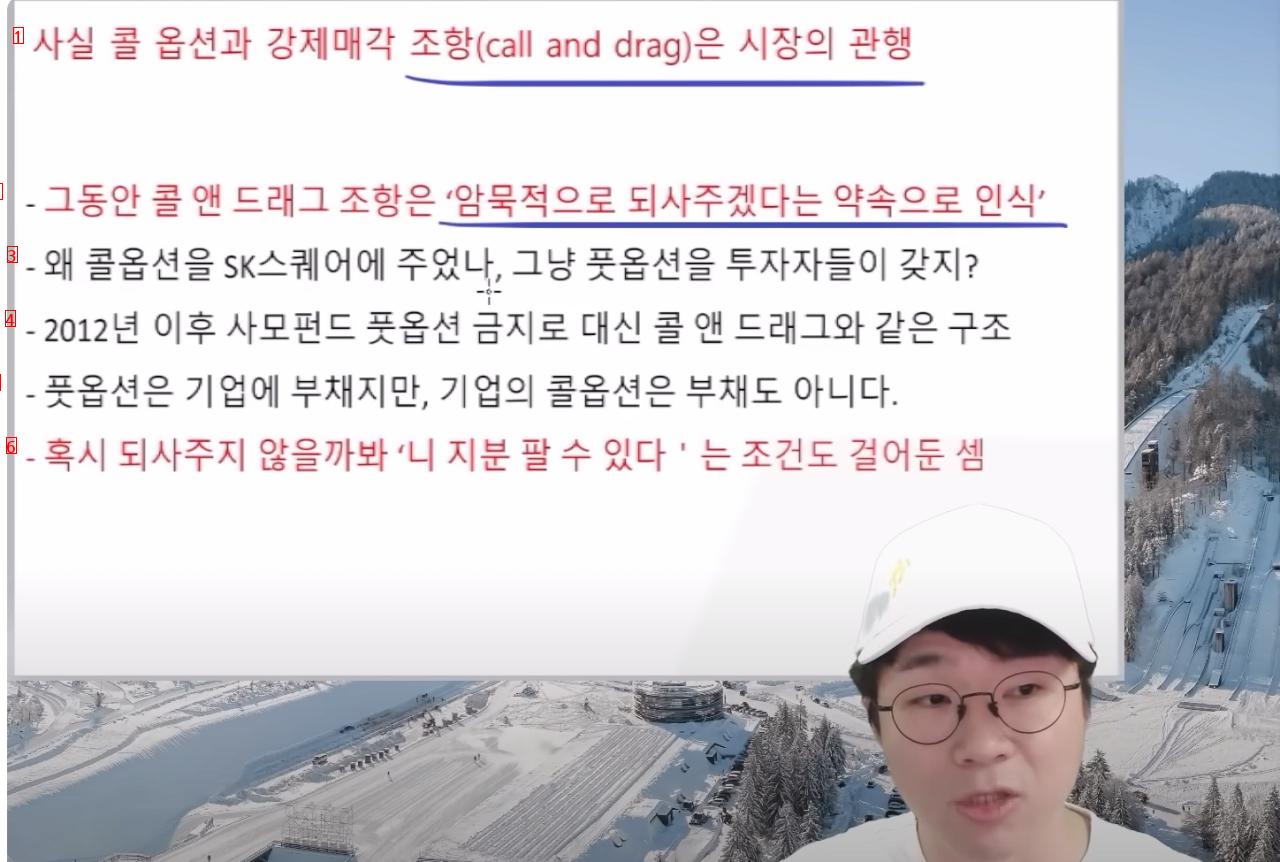

(1)In fact, call options and forced sale provisions call and drag are market practices

(2)- In the meantime, the call and drag clause is recognized as a promise to buy back implicitly

(3)- Why did they give a call option to Sksquare? They just have put options

(4)- Since 2012, private equity put options have been banned, and instead a call-and-drag-like structure has been established

(5)- A put option is a debt to a company, but a call option to a company is not even a debt

(6)- In case you don’t buy it back, you can sell your stake

If you don’t exercise the call option

If you compare it to a charter, it’s a situation where you can’t rent a charter. Then you should have a house

image text translation

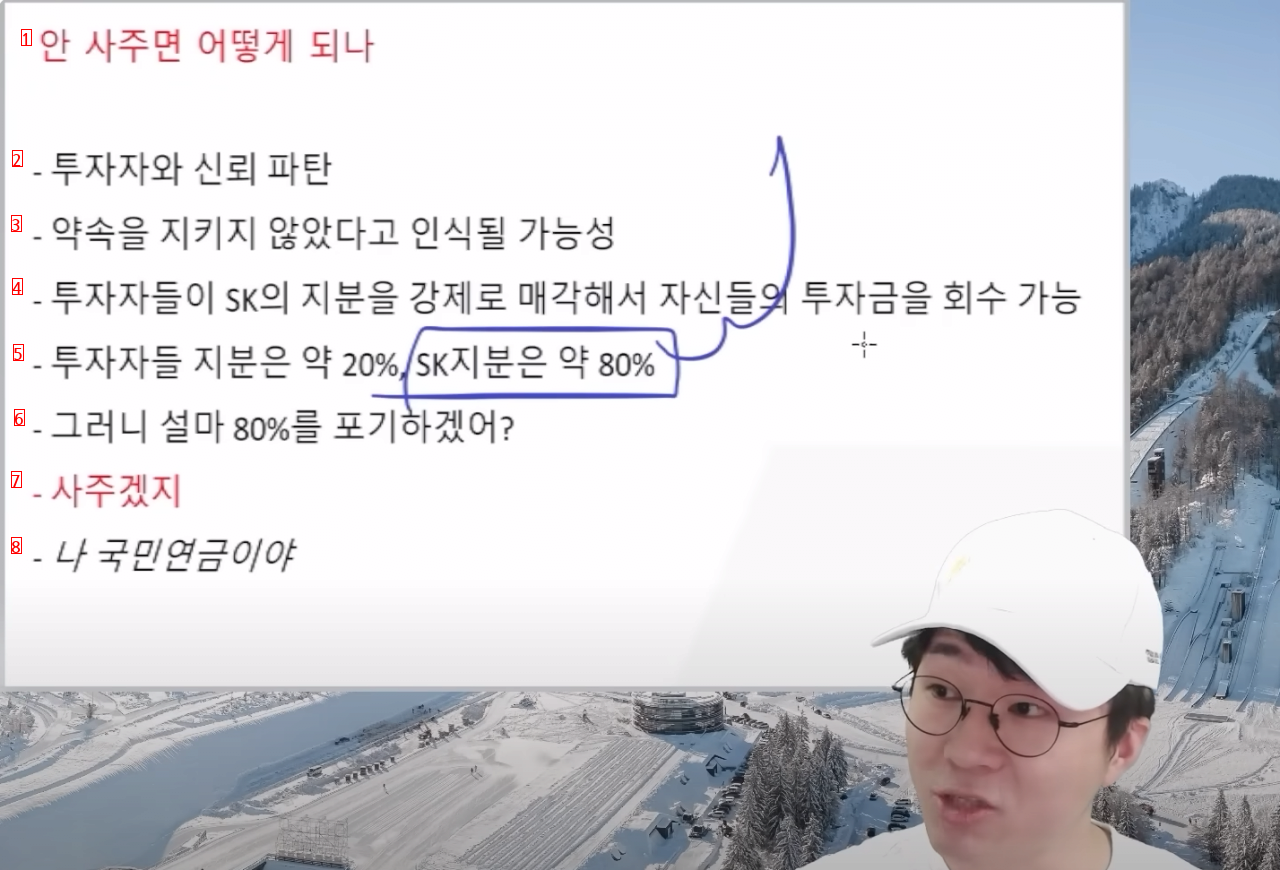

(1)What happens if I don’t buy it for you

(2)- a breakdown in investor confidence

(3)- the possibility of being perceived as not keeping a promise

(4)- Investors can force the sale of SK shares to recoup their investments

(5)- Investors’ shares are about 20 SK shares are about 80

(6)- So you don’t want to give up 80

(7)- They’ll buy it for us

(8)- I’m a national pensioner

SK Square, yes, you take it. You shouldn’t have done it without a new company

image text translation

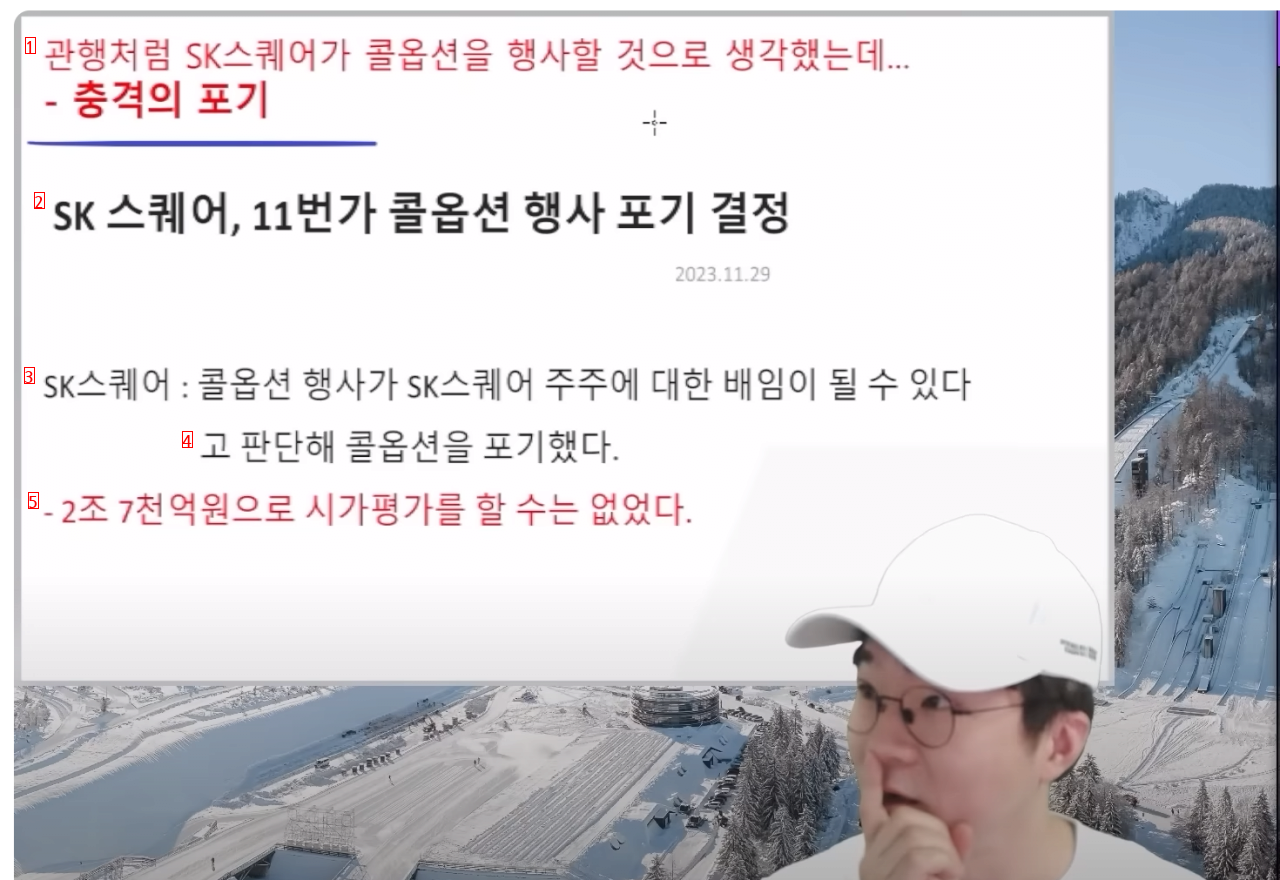

(1)I thought SK Square would exercise call options as is customary – give up shock

(2)SK Square 11th Street Call Options Decided To Give Up

(3)SK Square call option exercise could be breach of trust for SK Square shareholders

(4)I gave up the call option because I judged that

(5)- It was not possible to evaluate the market price at 2.7 trillion won

Investor, look at your conscience

It’s the same situation as renting a house on a deposit basis and taking a ㅌㅌ

image text translation

(1)angry investors

(2)The national pension fund is 350 billion HQ funds, 100 billion Saemaul Geumgo is 50 billion

(3)- In other words, SK, which has a stake of about 80, has virtually given up its management rights

(4)The failure to exercise call options, which has been a market practice, may be seen only as a gesture towards investors

(5)The call option of a company is a choice of a company, but it puts an end to the loose practice that was supposed to be sold as a put option

How much did SK Square determine the appropriate price for 11th Street

As if they thought the house was cheaper than the rent

image text translation

(1)How Much Have You Gone Your Call Option? How Much Have You Judging 11th Street’s Price

(2)- If investors sell for less than 550 billion won, SK’s stake could be worth zero

(3)- It’s all up to investors to decide how much SK will lose

(4)- If that’s the case, we’ll exercise the call option of 550 billion won

(5)Maybe it’s better to sell 11th Street more than that

(6)- You didn’t have the confidence to sell 11th Street for that value

I don’t know SK Square. Those who have 20% of the stake do it on their own. I’m going to slap my hands

80 of my shares. Whatever you want

If you dispose of everything and leave it, give it to me

image text translation

(1)In a nutshell, we give up management control of 11th Street

(2)- He has a stake of 80 percent

(3)- I think it’s better to give up than put in 550 billion won

(4)- Moreover, the 11th Street employees and executives are all SK employees

11th Street actually lost its hands by changing the name of SK PAY to 11 PAY lol