image text translation

(1)How was Kyochon doing

(2)① 47 minutes ago

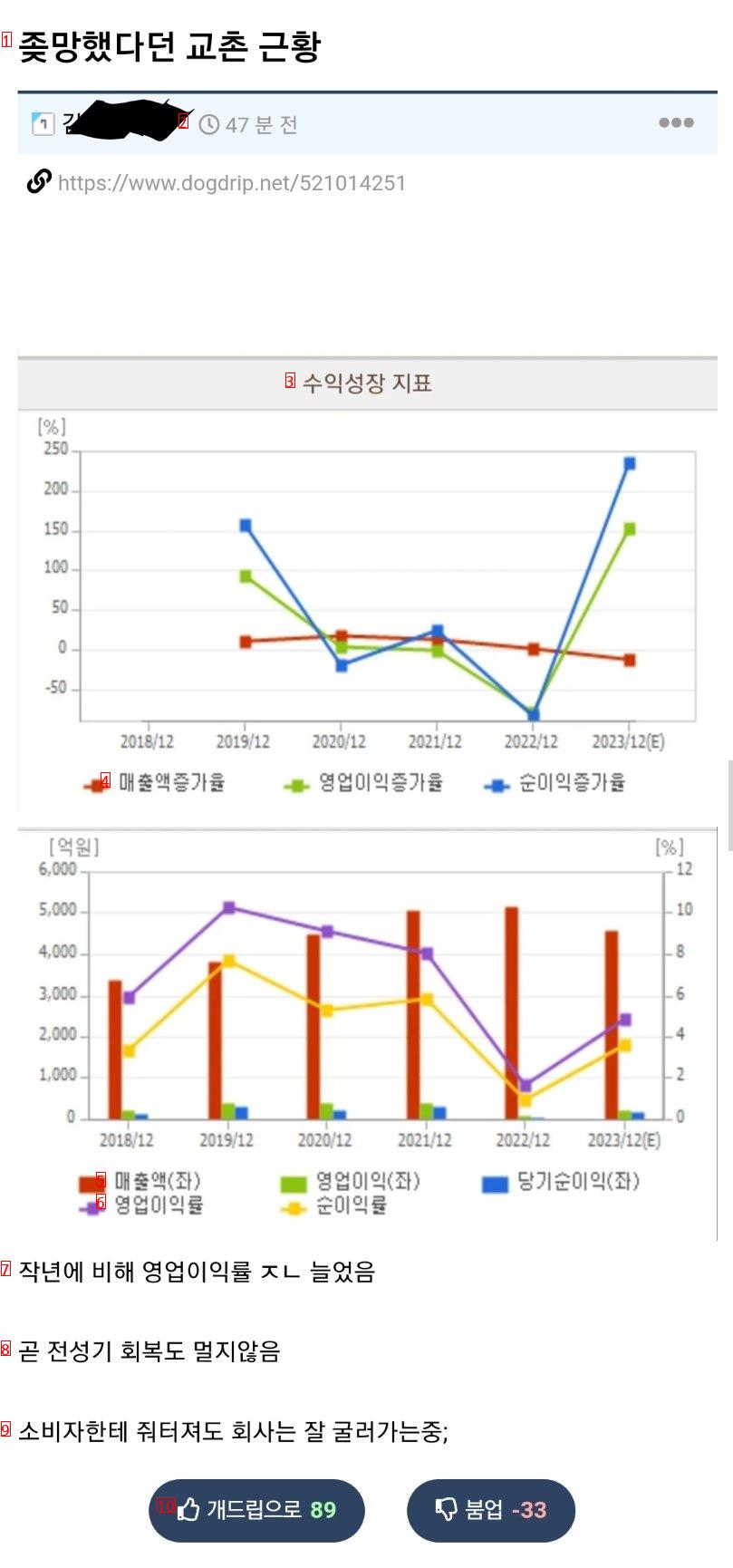

(3)an indicator of revenue growth

(4)Sales growth rate Operating profit growth rate Net profit growth rate

(5)Sales left Operating profit left Net profit left Net profit left for the current period

(6)Operating margin

(7)Operating margin increased ㄴ compared to last year

(8)The recovery of the heyday is not far away

(9)The company is working well even if it is given to consumers;

(10)89 boom-up with 3 drops -33

(1)The sales profit is on a modest downward spiral

image text translation

(2)As a metaphor, what would it be if operating profit and net profit rose rapidly

(3)It’s unconscionable that the product has a ridiculous cost of selling at some point

(4)It’s a leggy product

(5)But people might like it

(6)Let’s look at quantitative indicators, not ratios

(7)Earnings have been declining since 2019

No matter how much I look at it, it seems like we’ve cut costs or we’ve squeezed it